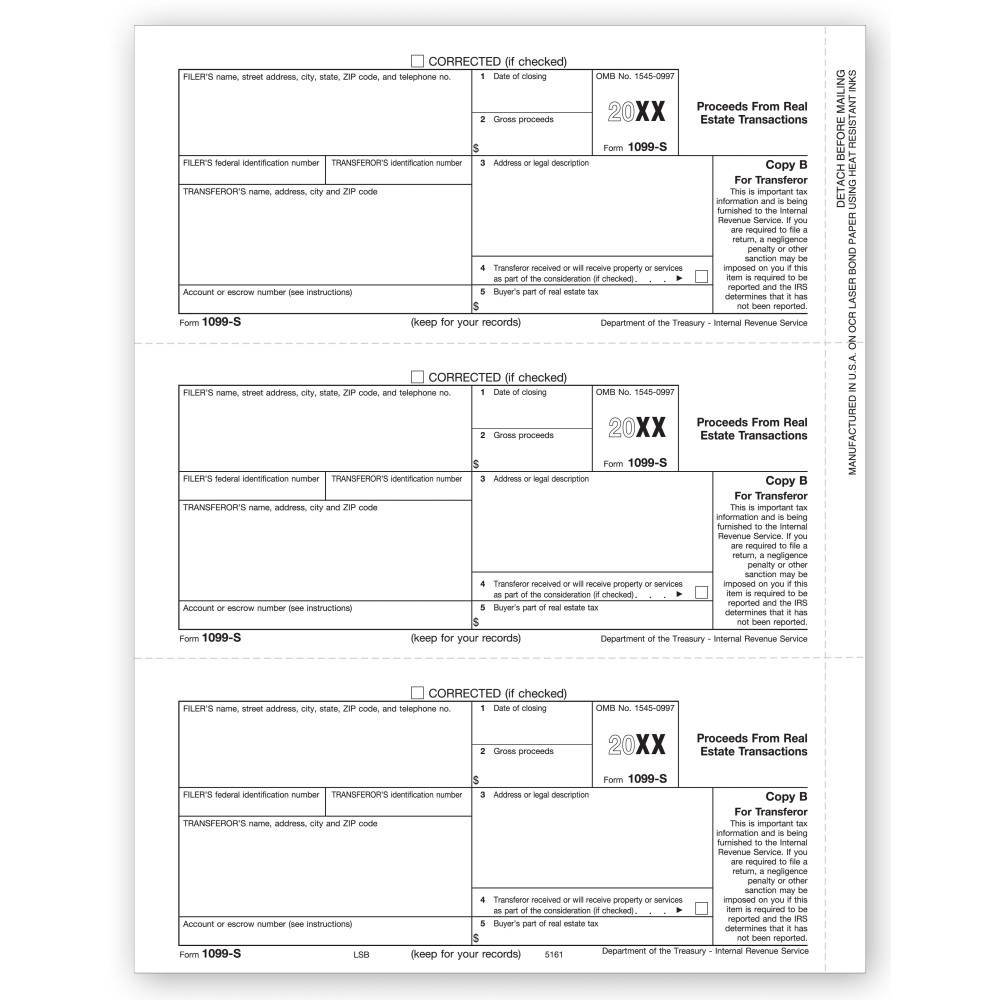

TF5161, Laser 1099-S Payer or Borrower Copy B

- Item# TF5161

- Size: 8 1/2" x 11"

- Payer/Borrower Copy B

- Three forms per sheet

- For laser or inkjet printers

- Min. Order: 100

Related Products

Meets all government and IRS filing requirements.Popular format is ideal for reporting proceeds from real estate transactions.

Paper Filing Due Date: To Recipient January 31st.

Real estate transactions are reported in tax form 1099-S. The individual or entity responsible for closing the deal is responsible for filing Copy A with the IRS and send the tax form 1099-S, Copy B to the transferor for the purpose of reporting gain arising from the transaction. Failure to report the item, if it is required to be reported and the IRS determines that the recipient has failed to do so attracts negligence penalty.

The Copy B of the form that you see on this page is accordance to the IRS rules including updates, if any. Three 1099-S, Copy B forms per page, these can tax forms can be printed on any laser or inkjet printer that supports letter size paper.

Don't forget the compatible envelopes: TF22222

There are no reviews for this product.

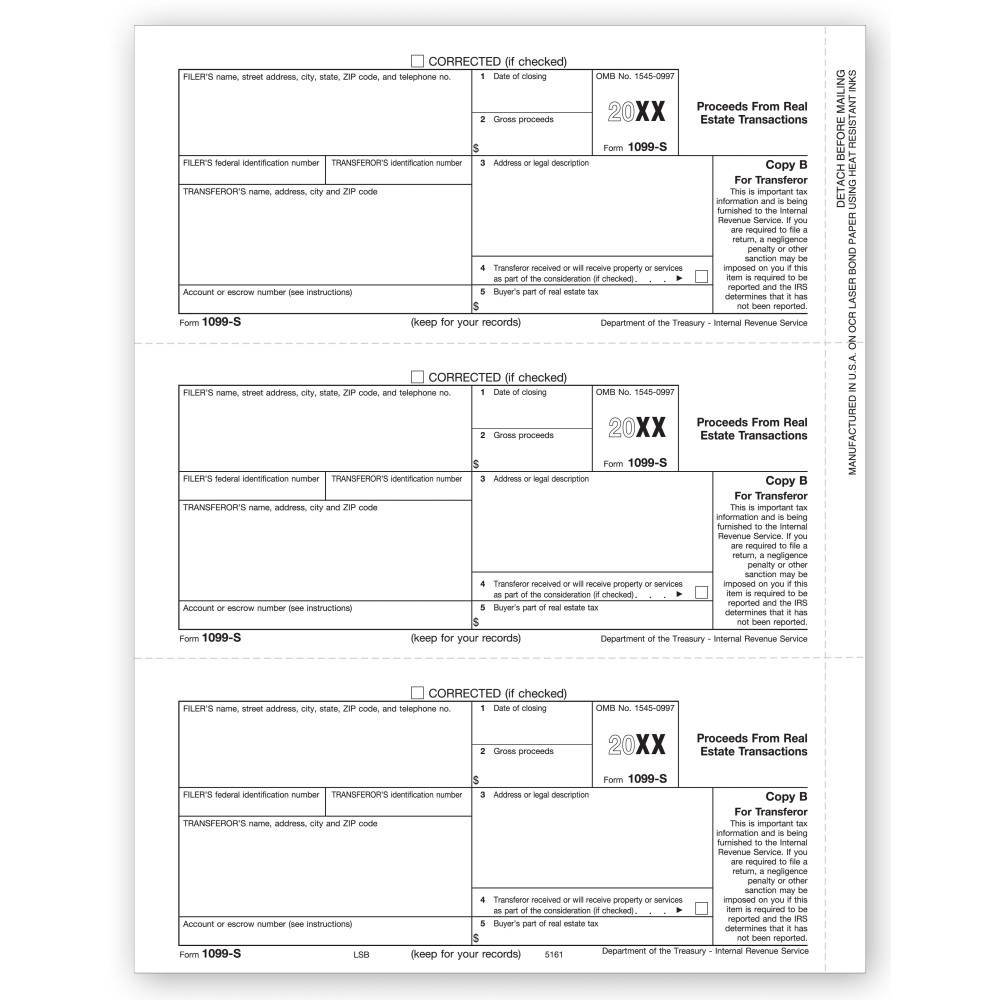

TF5161, Laser 1099-S Payer or Borrower Copy B

- Item# TF5161

- Size: 8 1/2" x 11"

- Payer/Borrower Copy B

- Three forms per sheet

- For laser or inkjet printers

- Min. Order: 100