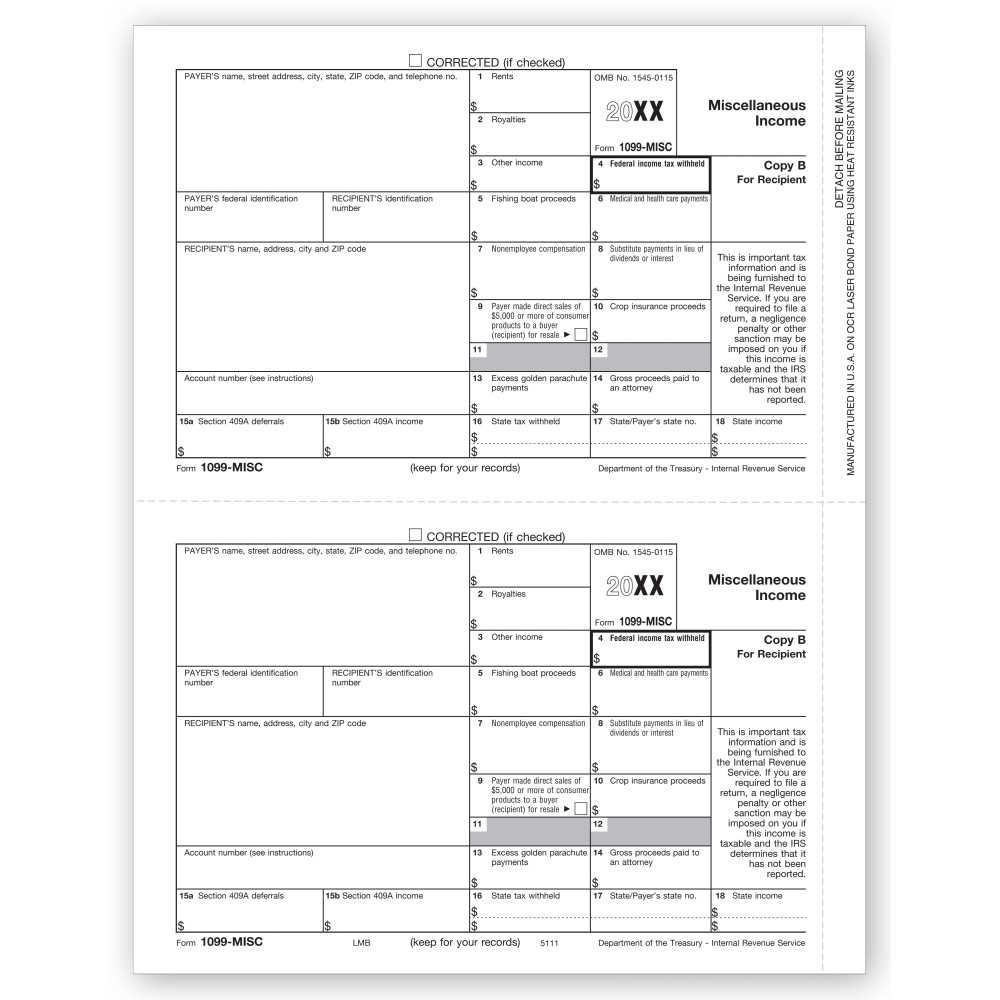

TF5111, Laser 1099-MISC Miscellaneous Income - Recipient Copy B

- Item# TF5111

- Size: 8 1/2" x 11"

- Printed on recycled paper

- Recipient Copy B

- Two filings per sheet

- Government approved 20# bond paper

- Sold in shrink-wrapped packages

- 100 forms per package

- Min. Order: 100 forms

Related Products

Paper Filing Due Date: To Recipient January 31st.

Use to Report :Miscellaneous payments, such as rents, royalties, medical and health payments and non-employee compensation.

Amounts to Report: Generally $600 or more (All Amounts or $10 or more in some cases).

You need to report a whole lot of financial information – incomes you pay to third parties – to the IRS and also send a copy to the recipient of the payment. All reporting is done in a set format. For miscellaneous payments above $600 ($10 for royalties and broker payments) during a year must be filed in 1099 Misc tax forms – with one copy to be sent to whom you make the payment. The recipient includes the income mentioned therein in his/her income tax return.

Don't forget the compatible envelopes: TF77772

There are no reviews for this product.

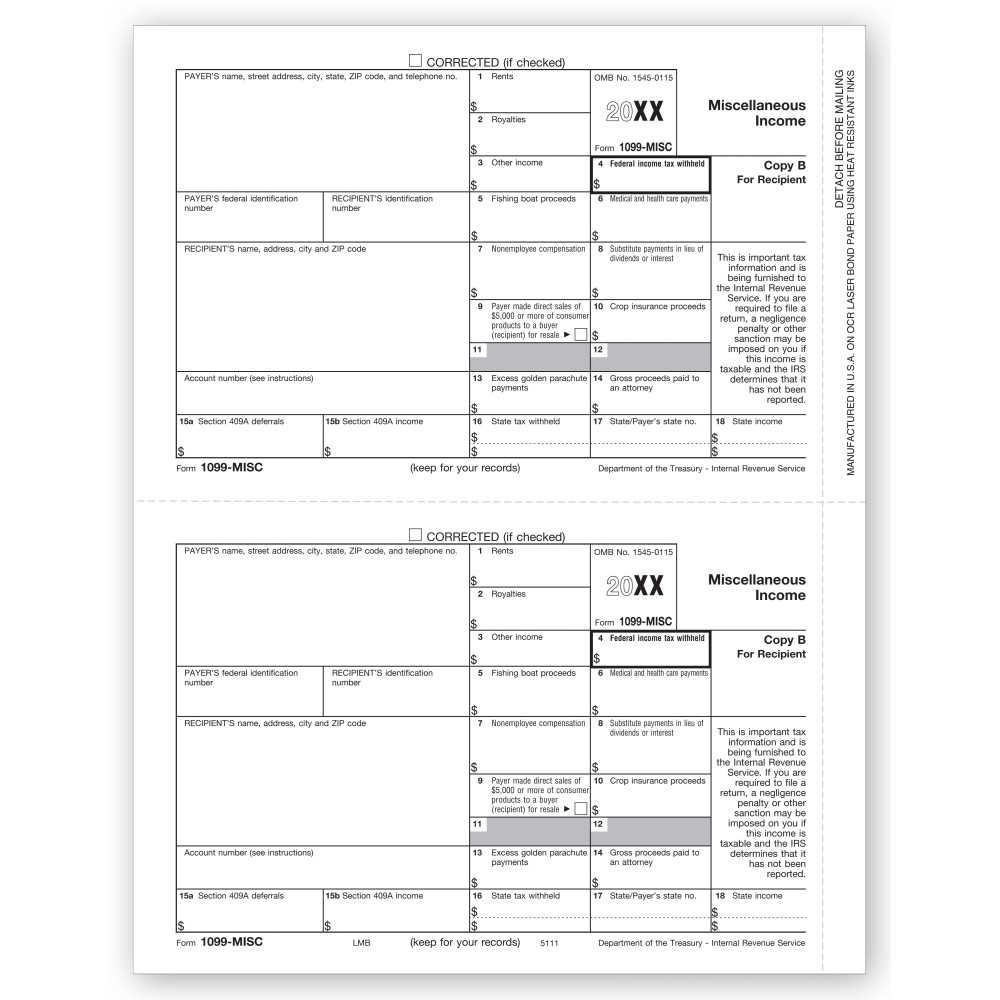

TF5111, Laser 1099-MISC Miscellaneous Income - Recipient Copy B

- Item# TF5111

- Size: 8 1/2" x 11"

- Printed on recycled paper

- Recipient Copy B

- Two filings per sheet

- Government approved 20# bond paper

- Sold in shrink-wrapped packages

- 100 forms per package

- Min. Order: 100 forms