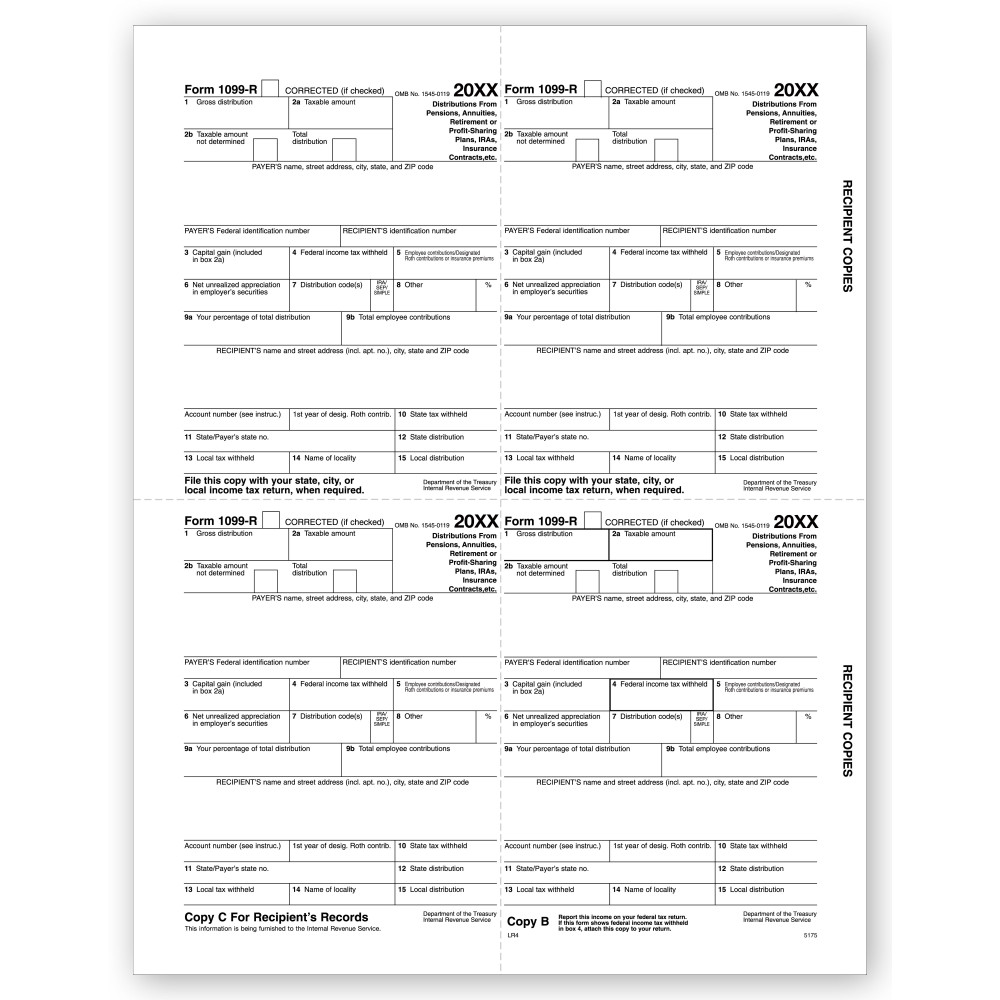

TF5175, Laser 1099-R 4-Up Recipient Copy B, C, 2

- Item# TF5175

- Size: 8 1/2" x 11"

- Two Copies 2, 1 Copy B and 1 Copy C

- One recipient per page

- Can be used with laser or inkjet printers

- 4-up

- Min. Order: 100

Related Products

Meets all government and IRS filing requirements.Popular format is ideal for reporting distributions from retirement or profit-sharing plans.

Paper Filing Due Date: To Recipient January 31st.

Distributions from pensions, annuities, retirement plans, IRAs, or insurance contracts are reported to the IRA by the payer in 1099-R. Besides the gross distribution during the year, the information also includes the amount that is taxable, federal income tax that has been held and the contributions made to the investment or premiums paid. The IRS, the state or the local tax department (if applicable) and plan owner receive a copy each.

We offer 4 Up 1099-R tax forms – two copies 2, 1 Copy B and 1 Copy C on a single letter size sheet. One recipient per page, this is an innovative and time saving format.

Don't forget the compatible envelopes: TF61612

There are no reviews for this product.

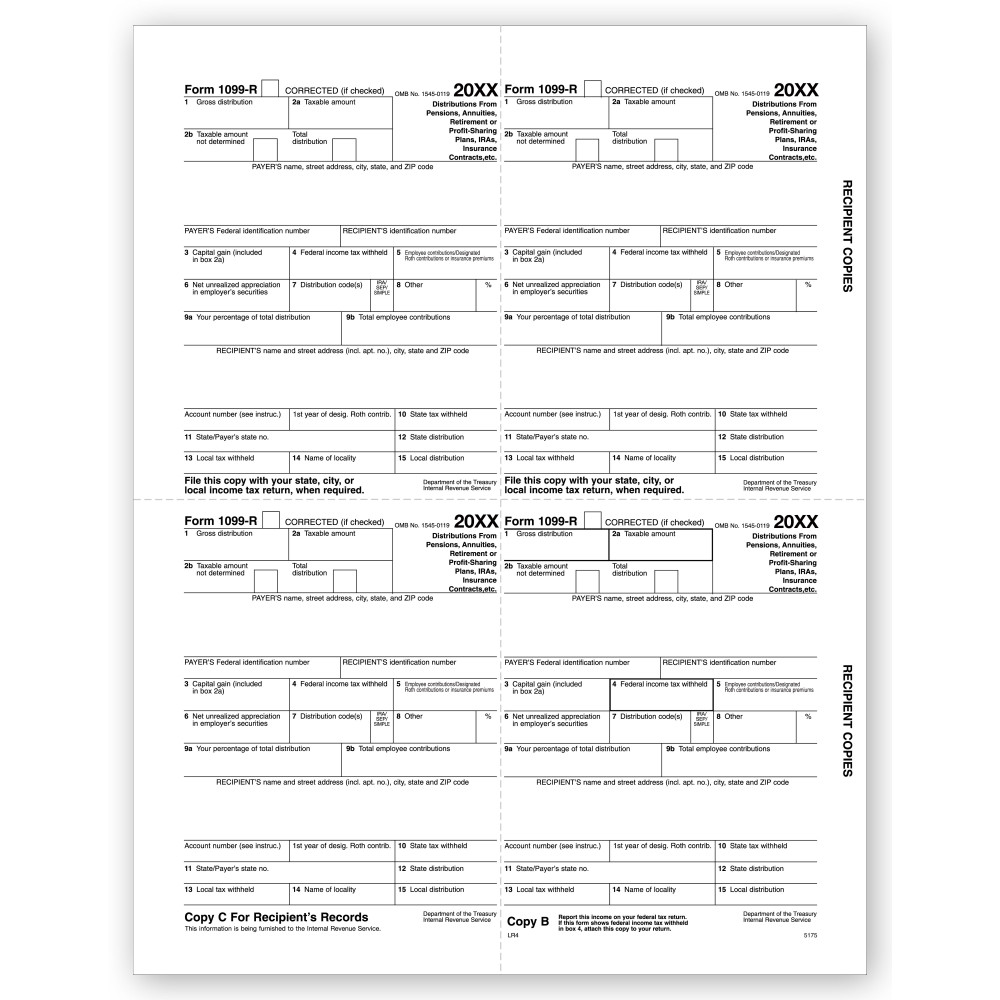

TF5175, Laser 1099-R 4-Up Recipient Copy B, C, 2

- Item# TF5175

- Size: 8 1/2" x 11"

- Two Copies 2, 1 Copy B and 1 Copy C

- One recipient per page

- Can be used with laser or inkjet printers

- 4-up

- Min. Order: 100