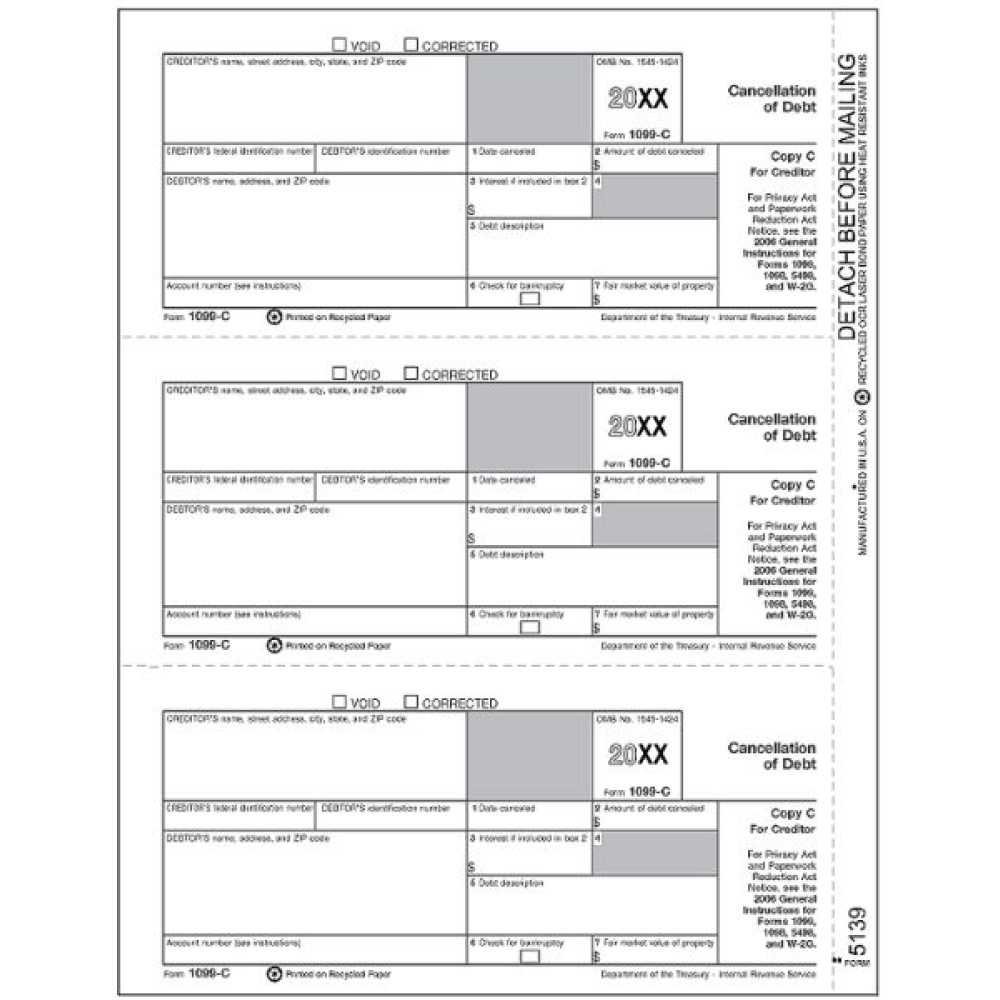

TF5139, Laser 1099-C Copy C

- Item# TF5139

- Size: 8 1/2" x 11"

- Creditor Copy C

- Three forms per sheet

- For laser or inkjet printers

- Min. Order: 100

Related Products

Paper Filing Due Date: To Recipient January 31st.

While filing IRS form 1099 the general norm is to print three copies of the form. Whereas Copy A and Copy B are meant for the IRS and the recipient of the income, Copy C is generally for the payer’s records. If required, the Copy C may also be sent to the State Tax Authority. We offer all three versions of the 1099 forms in the format required by the IRS. The product that you see on this page is the Copy C of the 1099-C tax form that is filed for reporting cancellation of a debt. A cancelled debt is a deemed income of the debtor, who is required to pay tax on it

Use to Report: Cancellation of a debt owed to a financial institution, the Federal Government, a credit union, FDIC, a military department, the U.S. Postal Service or any organization having a significant trade or business of lending money.

Amounts to report: $600 or more.

Don't forget the compatible envelopes: TF22222

There are no reviews for this product.

TF5139, Laser 1099-C Copy C

- Item# TF5139

- Size: 8 1/2" x 11"

- Creditor Copy C

- Three forms per sheet

- For laser or inkjet printers

- Min. Order: 100