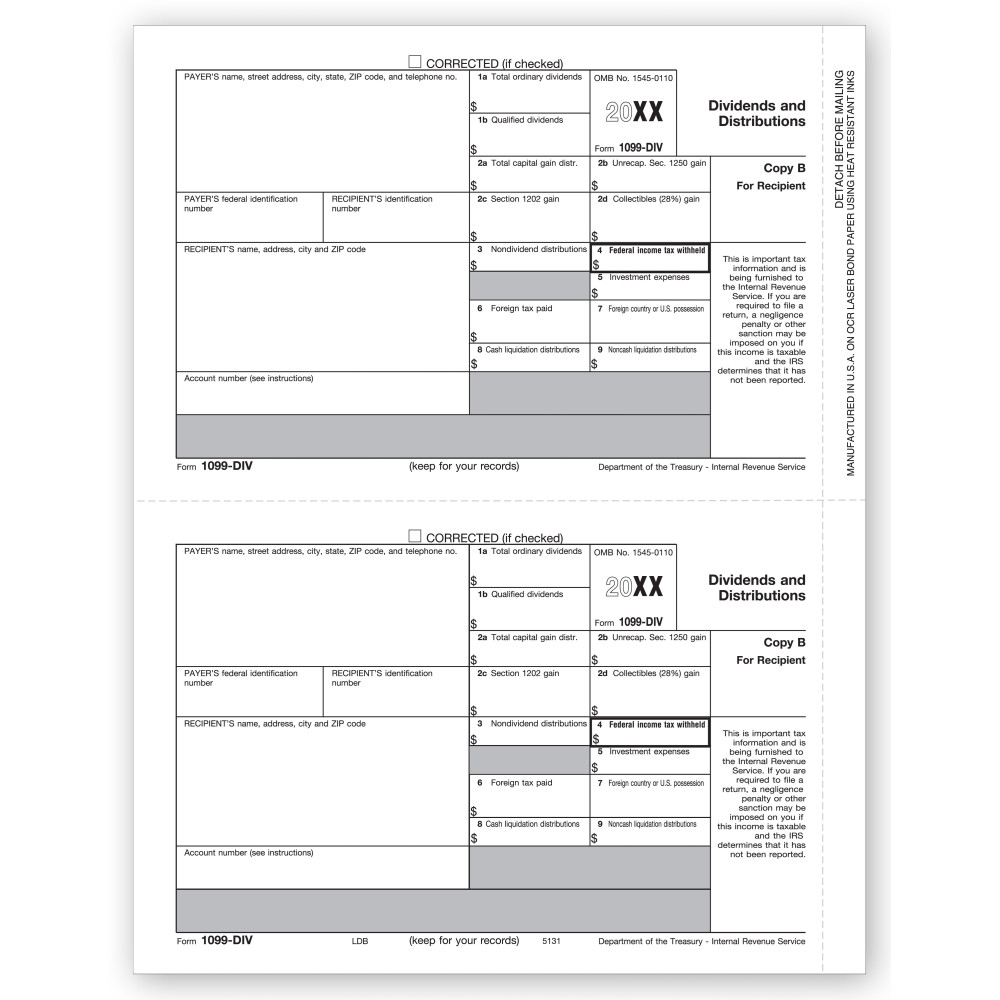

TF5131, Laser 1099-DIV Dividend Income - Recipient Copy B

- Item# TF5131

- Size: 8 1/2" x 11"

- Printed on recycled paper

- Recipient Copy B

- Micro-perforated

- Two 1099 forms per sheet

- Government approved 20# bond stock

- Comes in shrink-wrapped packages of 100

- Min. Order: 100 sheets (1 package)

Related Products

Paper Filing Due Date: To Recipient January 31st.

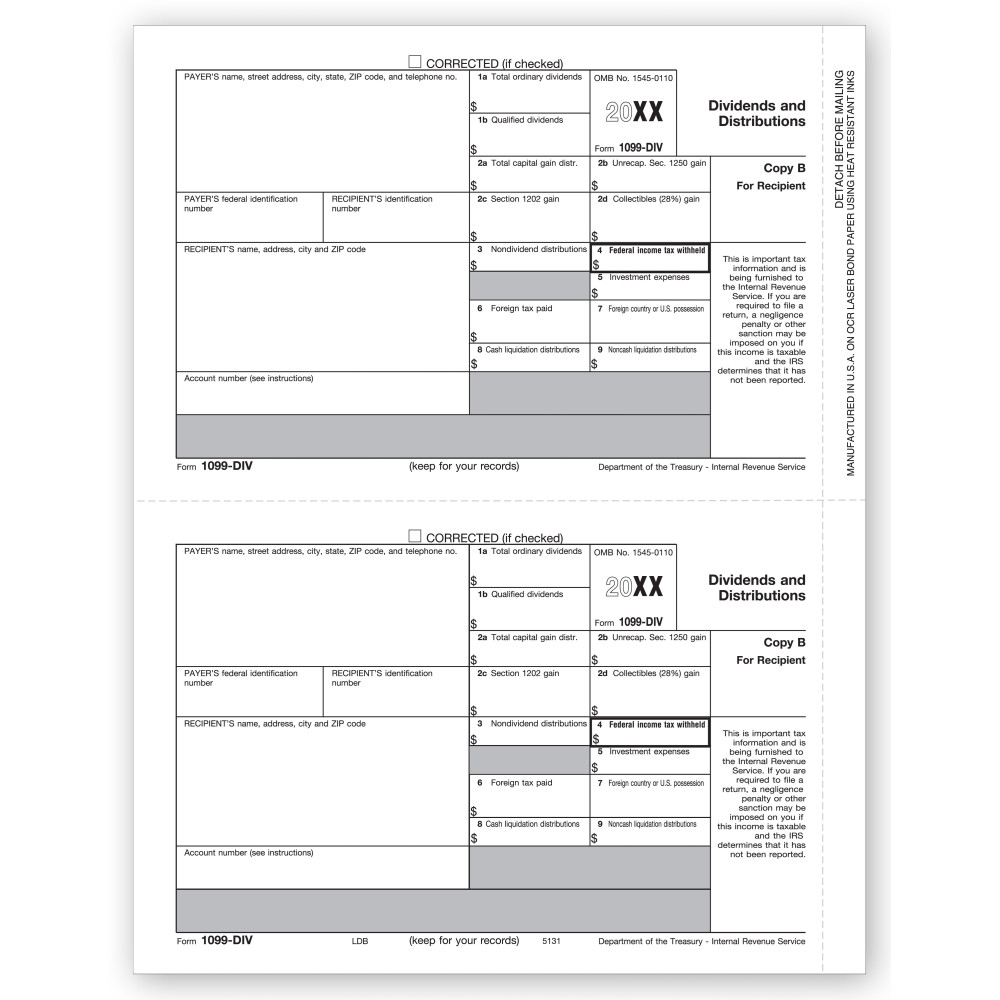

Use to Report: Distributions, such as dividends, capital gain distributions, or nontaxable distributions that were paid on stock and liquidation distributions.

Amounts to Report: $10 or more, except $600 or more for liquidations.

Regardless of whether it is a company or a mutual fund, all dividends paid to investors must be reported to the IRS in a set format. Investors too get Copy B giving details of dividends paid directly or transferred to their bank accounts on the basis of which they file their income tax returns. The 1099 form applicable to this type of income is known as 1099-DIV.

We offer 1099-DIV tax forms Copy B presented in a two forms per sheet format. These can be printed on any laser or inkjet printer. The micro perforation allows easy and hassle free separation. Please check software compatibility before placing your order.

Don't forget the compatible envelopes: TF77772

There are no reviews for this product.

TF5131, Laser 1099-DIV Dividend Income - Recipient Copy B

- Item# TF5131

- Size: 8 1/2" x 11"

- Printed on recycled paper

- Recipient Copy B

- Micro-perforated

- Two 1099 forms per sheet

- Government approved 20# bond stock

- Comes in shrink-wrapped packages of 100

- Min. Order: 100 sheets (1 package)