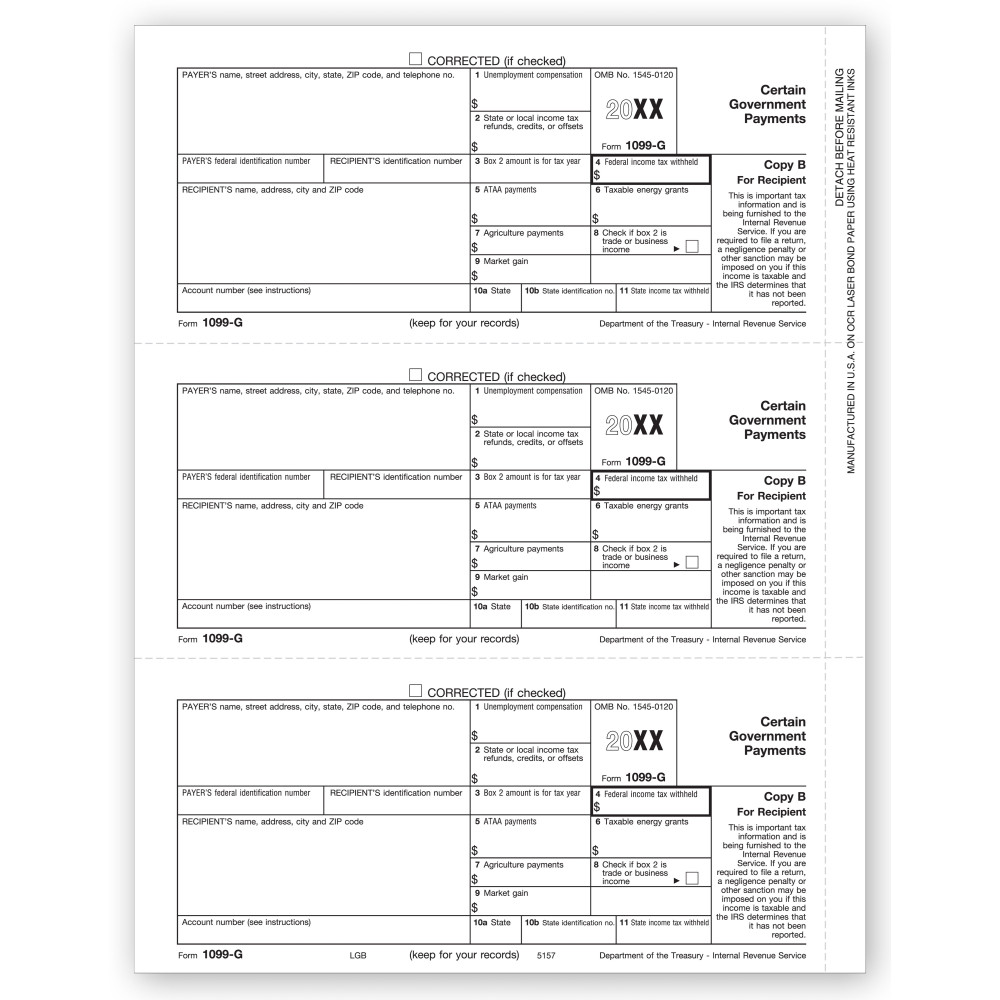

TF5157, Laser 1099-G Recipient Copy B

- Item# TF5157

- Size: 8 1/2" x 11"

- Recipient Copy B

- Three 1099's per sheet

- 100 forms per package

- Min. Order: 100

Related Products

Meets all government and IRS filing requirements.Popular format is ideal for reporting certain government payments.

Paper Filing Due Date: To Recipient January 31st.

Payers of unemployment compensation; income tax refunds, credits, or offsets; reemployment trade adjustment assistance (RTAA) payments; taxable grants; or agricultural payments must file the information with the IRS and also furnish the same information in tax form 1099-G that is Copy B, to the recipients of such payments. The 1099-G tax form applies to units of federal, state or local governments. Amounts received by government units on account of payments on a Commodity Credit Corporation (CCC) loan must also be mentioned.

The 1099 tax forms on offer t our website conform to IRS regulation, complete with any amendments, if any. This 1099-G Copy B is in a three forms per sheet format and supplied in shrink wrapped packages of 100 sheets.

There are no reviews for this product.

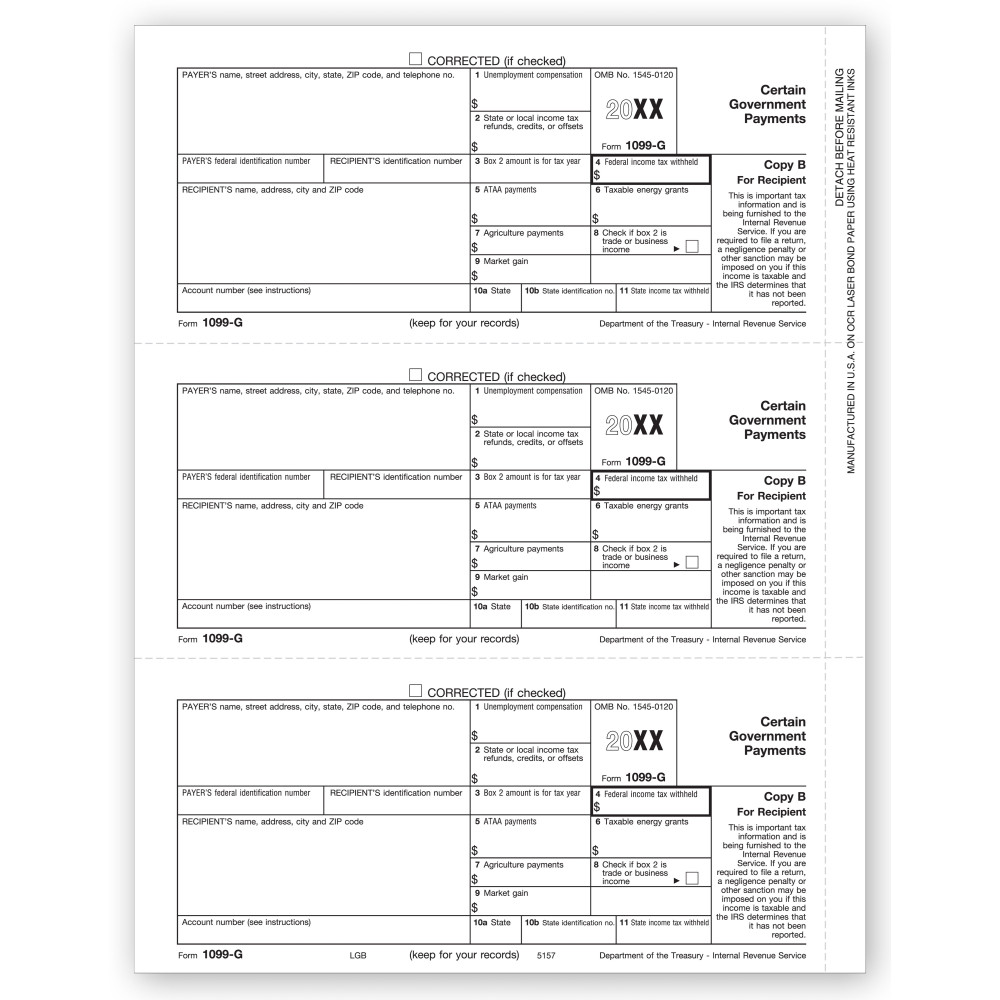

TF5157, Laser 1099-G Recipient Copy B

- Item# TF5157

- Size: 8 1/2" x 11"

- Recipient Copy B

- Three 1099's per sheet

- 100 forms per package

- Min. Order: 100