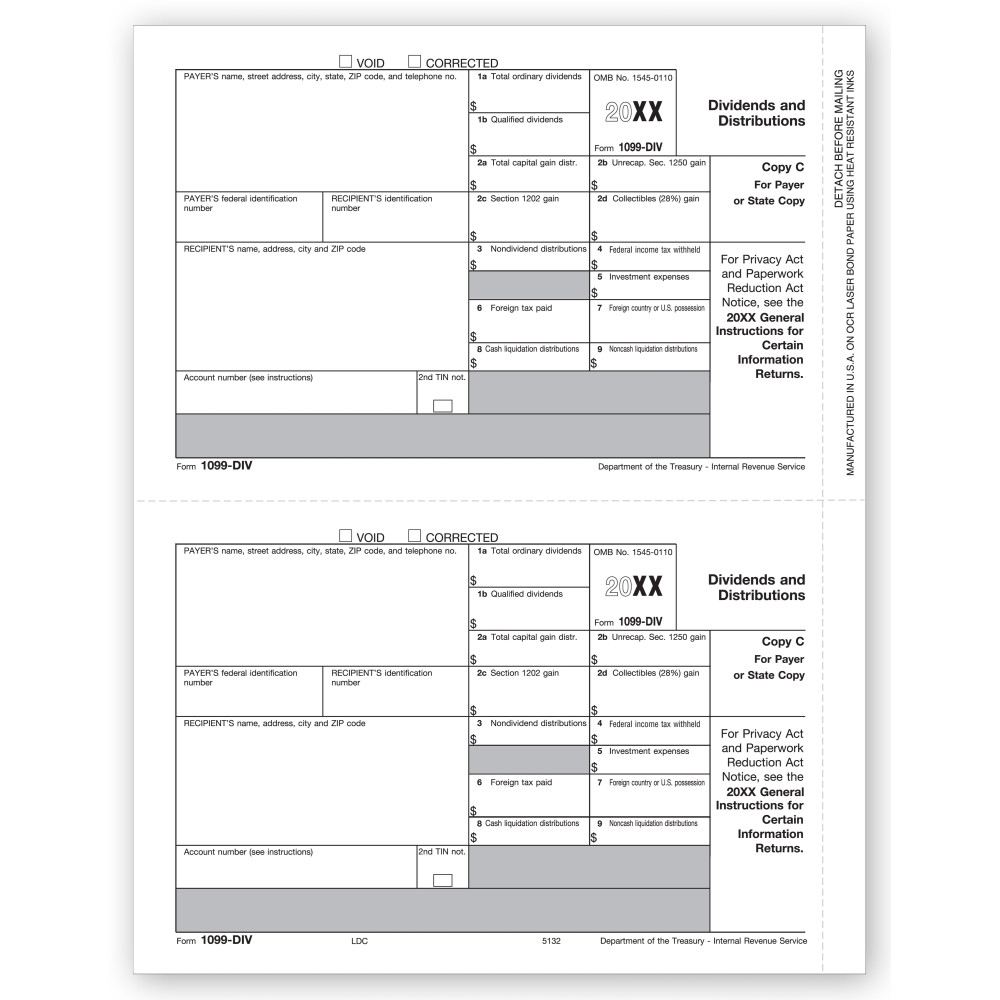

TF5132, Laser 1099-DIV Dividend Income - State Copy C

- Item# TF5132

- Size: 8 1/2" x 11"

- Printed on recycled paper

- State Copy C

- Micro-perforated

- Two 1099 forms per sheet

- Government approved 20# bond stock

- Comes in shrink-wrapped packages of 100

- Min. Order: 100 sheets (1 package)

Related Products

Paper Filing Due Date: To Recipient January 31st.

Use to Report: Distributions, such as dividends, capital gain distributions, or nontaxable distributions that were paid on stock and liquidation distributions.

Amounts to Report: $10 or more, except $600 or more for liquidations.

Form 1099-Div is the IRS tax form for reporting dividends and distributions. The reporting is sent to the IRS (Copy A) and to the payee or recipient (Copy B). A third copy or Copy C is the State copy to be sent to the State Tax Authority, if needed. Alternatively, it remains with the payer’s record books.

Don't forget the compatible envelopes: TF77772

There are no reviews for this product.

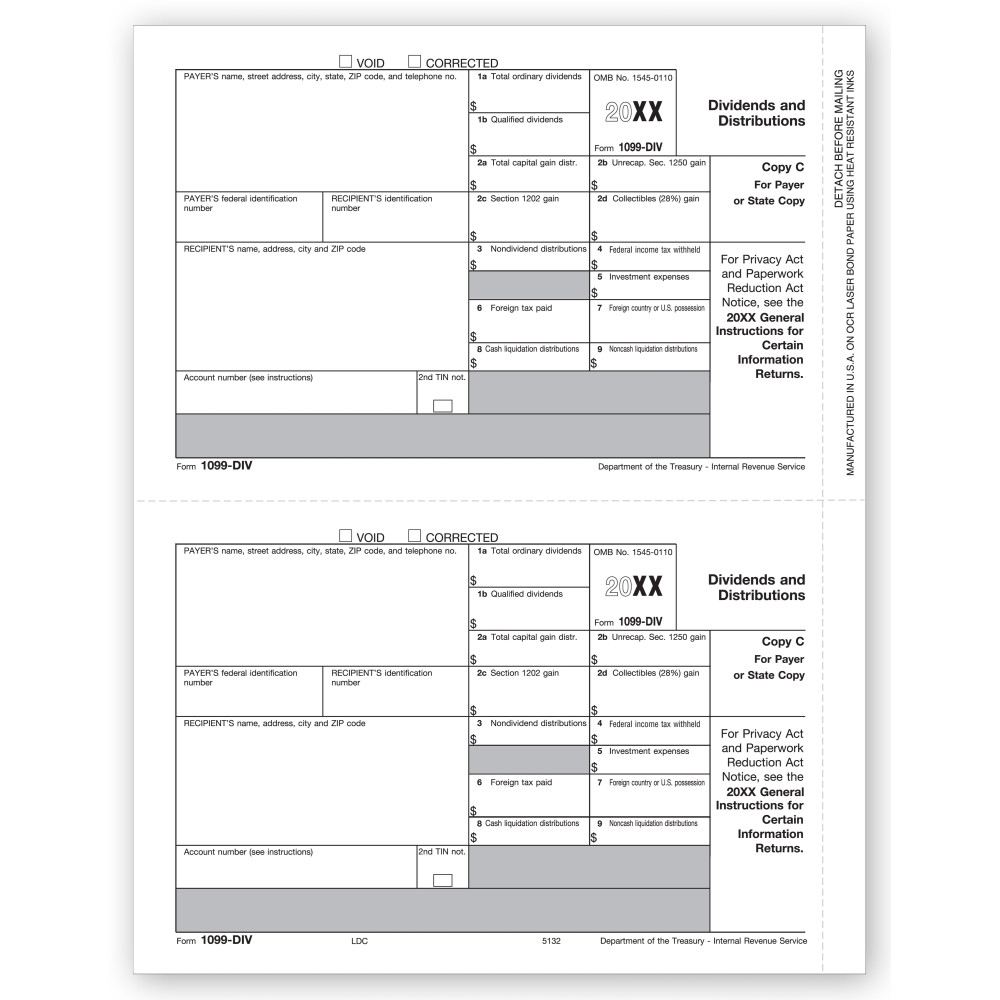

TF5132, Laser 1099-DIV Dividend Income - State Copy C

- Item# TF5132

- Size: 8 1/2" x 11"

- Printed on recycled paper

- State Copy C

- Micro-perforated

- Two 1099 forms per sheet

- Government approved 20# bond stock

- Comes in shrink-wrapped packages of 100

- Min. Order: 100 sheets (1 package)