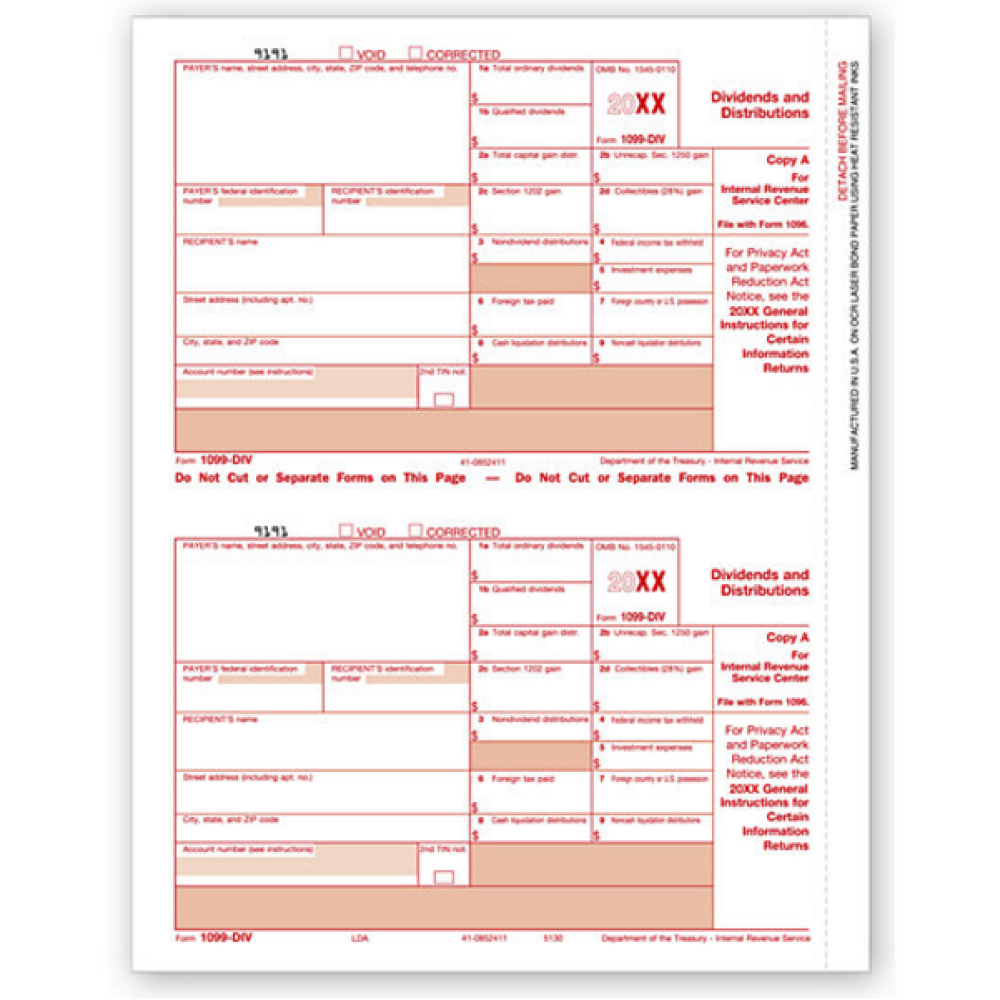

TF5130, Laser 1099-DIV Dividend Income - Federal Copy A

- Item# TF5130

- Size: 8 1/2" x 11"

- Printed on recycled paper

- Federal Copy A

- Micro-perforated

- Two 1099 forms per sheet

- Government approved 20# bond stock

- Comes in shrink-wrapped packages of 100

- Min. Order: 100 sheets (1 package)

Related Products

Paper Filing Due Date: To Recipient January 31st.

Use to Report: Distributions, such as dividends, capital gain distributions, or nontaxable distributions that were paid on stock and liquidation distributions.

Amounts to Report: $10 or more, except $600 or more for liquidations.

Whenever a company pays dividend it sends a tax form 1099-DIV to its shareholders. In case a broker is holding the stock on behalf of a client, it is the broker who remits it. While investors get one copy, the original or Copy A or federal copy is sent to the Internal Revenue Service Center for monitoring purposes.

The tax form 1099–DIV Federal Copy A you see here on this page complies with the IRS regulation. The micro perforated two forms on one sheet can be printed on any laser or inkjet printer that supports letter size paper. Supplied in shrink wrapped packages, the minimum quantity that you can order is 200 forms (100 sheets).

Don't forget the compatible envelopes: TF77772

There are no reviews for this product.

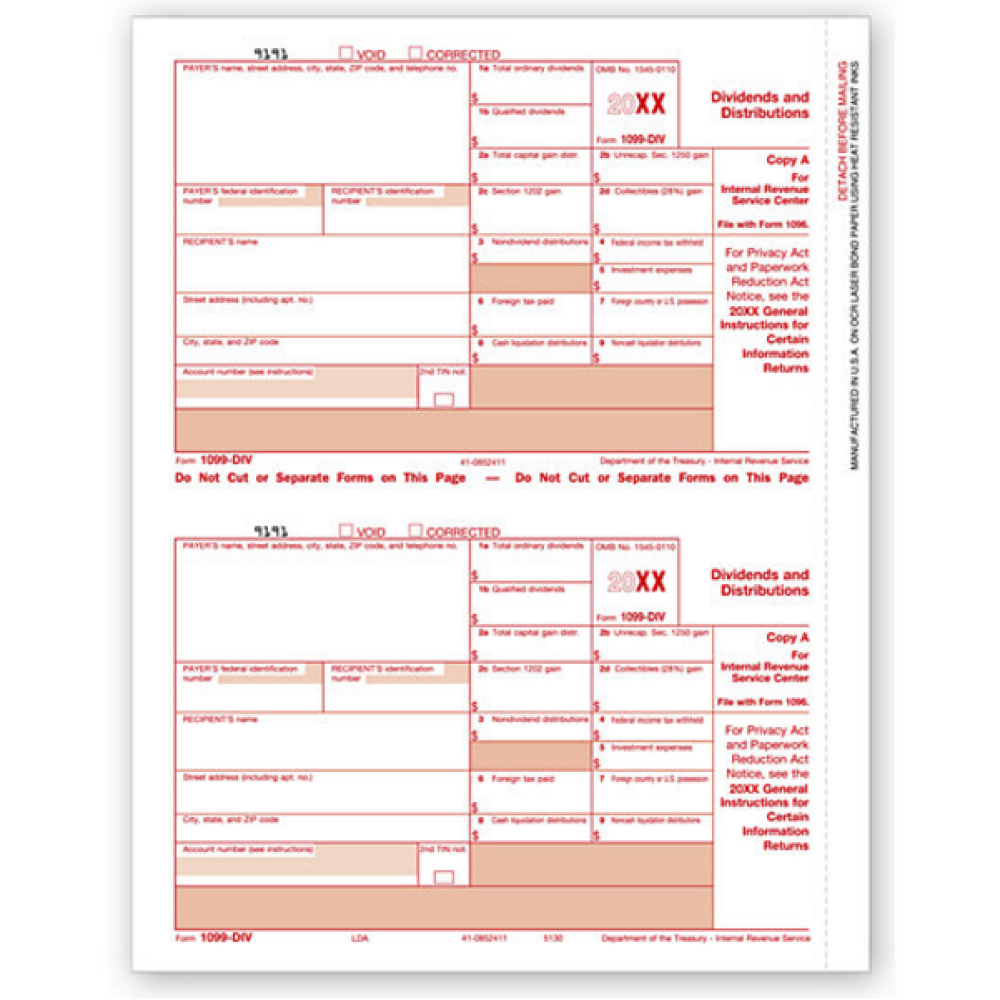

TF5130, Laser 1099-DIV Dividend Income - Federal Copy A

- Item# TF5130

- Size: 8 1/2" x 11"

- Printed on recycled paper

- Federal Copy A

- Micro-perforated

- Two 1099 forms per sheet

- Government approved 20# bond stock

- Comes in shrink-wrapped packages of 100

- Min. Order: 100 sheets (1 package)