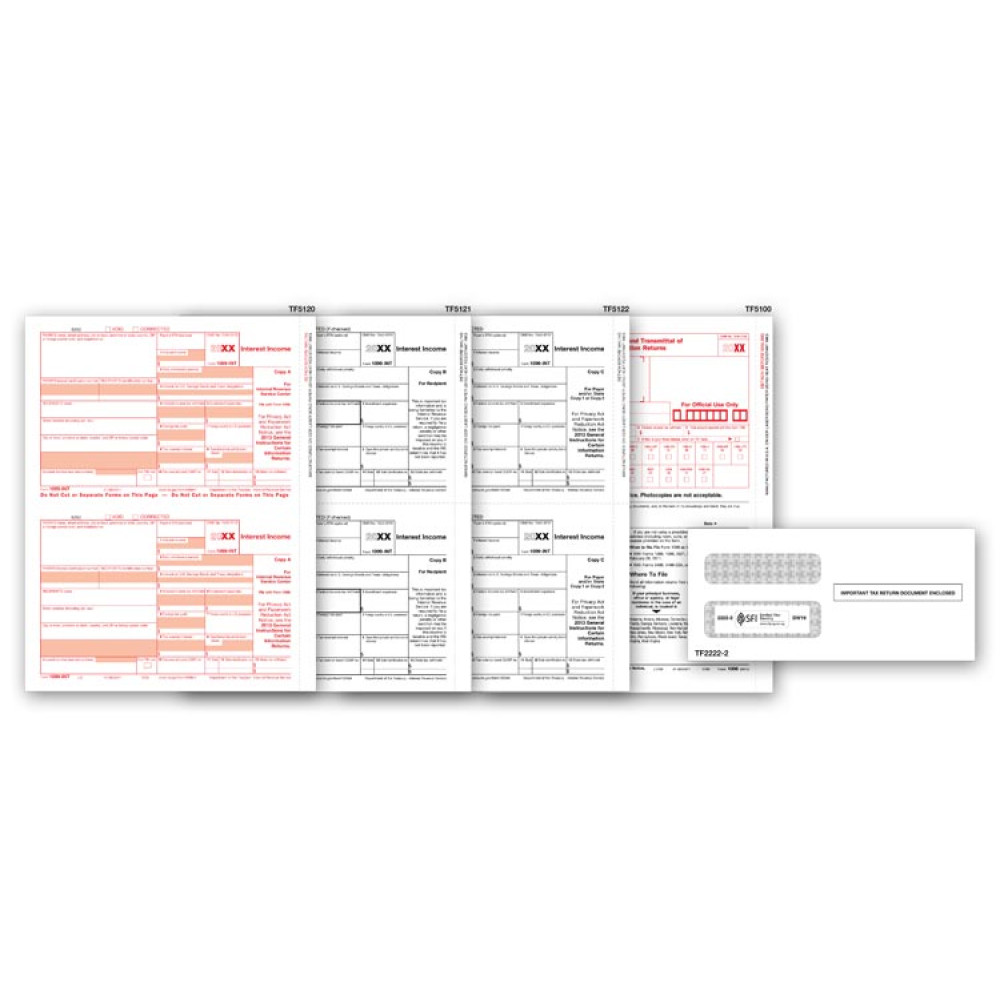

- Item# TF6106E

- Size: 8 1/2" x 11"

- 50 Filings per package

- 3 forms per sheet

- Meets 4-part state filing requirements

- Report $10 or more ($600 or more in some cases)

- Package Includes:

- - 50 Federal Copy A

- - 50 Recipient Copy B

- - 100 Payer and/or State Copy C

- - 1 Laser 1096 Transmittal

- - 50 Envelopes

- Min. Order: 1 Pack

Related Products

Popular format is ideal for reporting interest income. All the laser 1099-INT tax forms and envelopes you need in 1 package, for 1 low price!

Paper Filing Due Date: To Recipient January 31st.

An annual tax statement is provided by payers of interest income to recipients on tax form 1099-INT and the same information is provided is reported to the Internal Revenue Service. Interest reported on tax forms 1099-INT includes interest paid on savings accounts, interest-bearing checking accounts, and US Savings bonds.

This Form is also used to report other tax items related to your interest income, such as early withdrawal penalties and federal tax withheld. Recipients need an extra copy for attaching with their annual income tax return in case any tax has been withheld. For this purpose, we offer a set of 1099-INT tax forms that meets 4-part state filing requirements. Sold in packages of 50 sets, each sheet has three forms and includes 1 1096 laser transmittal and 50 self seal envelopes.

- Item# TF6106E

- Size: 8 1/2" x 11"

- 50 Filings per package

- 3 forms per sheet

- Meets 4-part state filing requirements

- Report $10 or more ($600 or more in some cases)

- Package Includes:

- - 50 Federal Copy A

- - 50 Recipient Copy B

- - 100 Payer and/or State Copy C

- - 1 Laser 1096 Transmittal

- - 50 Envelopes

- Min. Order: 1 Pack