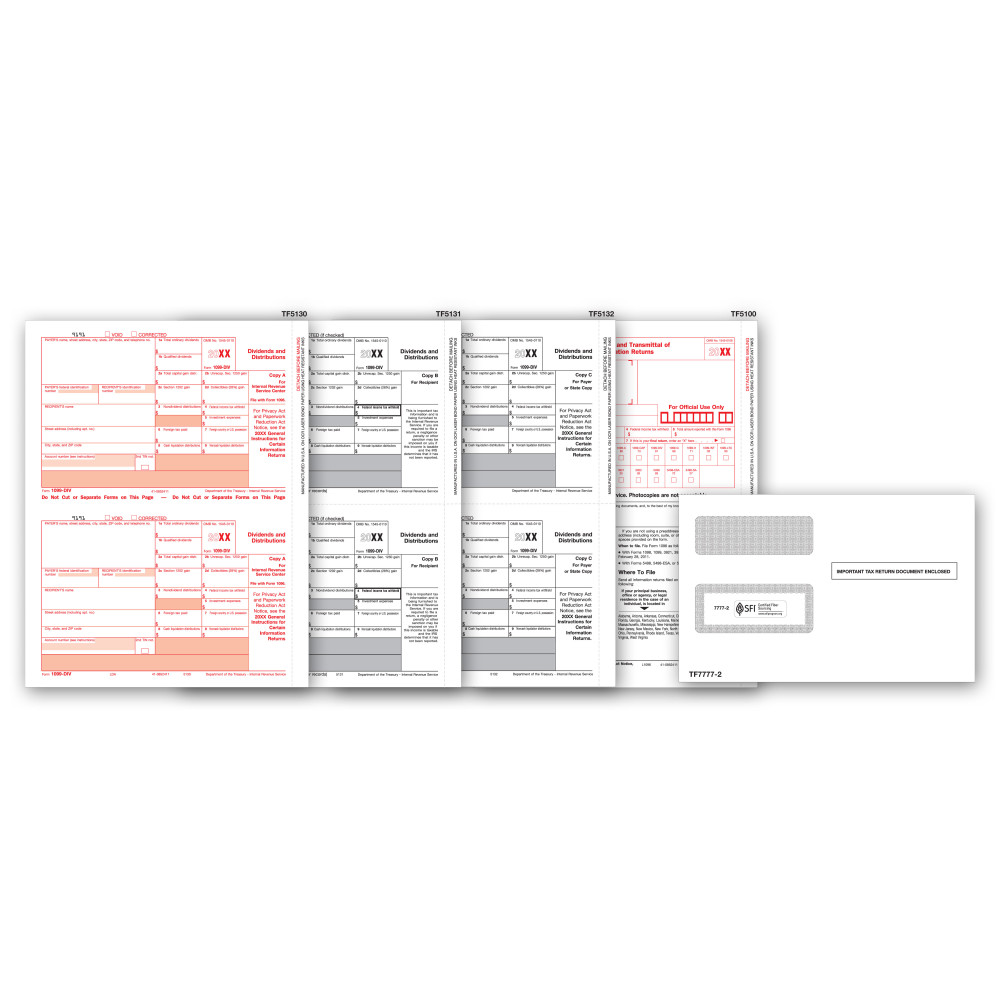

TF6107E, Laser 1099 Forms with Envelopes - Dividend Income - 4 Part

- Item# TF6107E

- Size: 8 1/2" x 11"

- Meets 4-part state filing requirements

- 2 Filings per sheet

- Report $10 or more, except $600 or more for liquidations

- Includes:

- - 50 Federal Copy A

- - 50 Recipient Copy B

- - 100 Payer and/or State Copy C

- - 3 Laser 1096 Transmittals

- - 50 Envelopes

- Min. Order: 1 Pack

Related Products

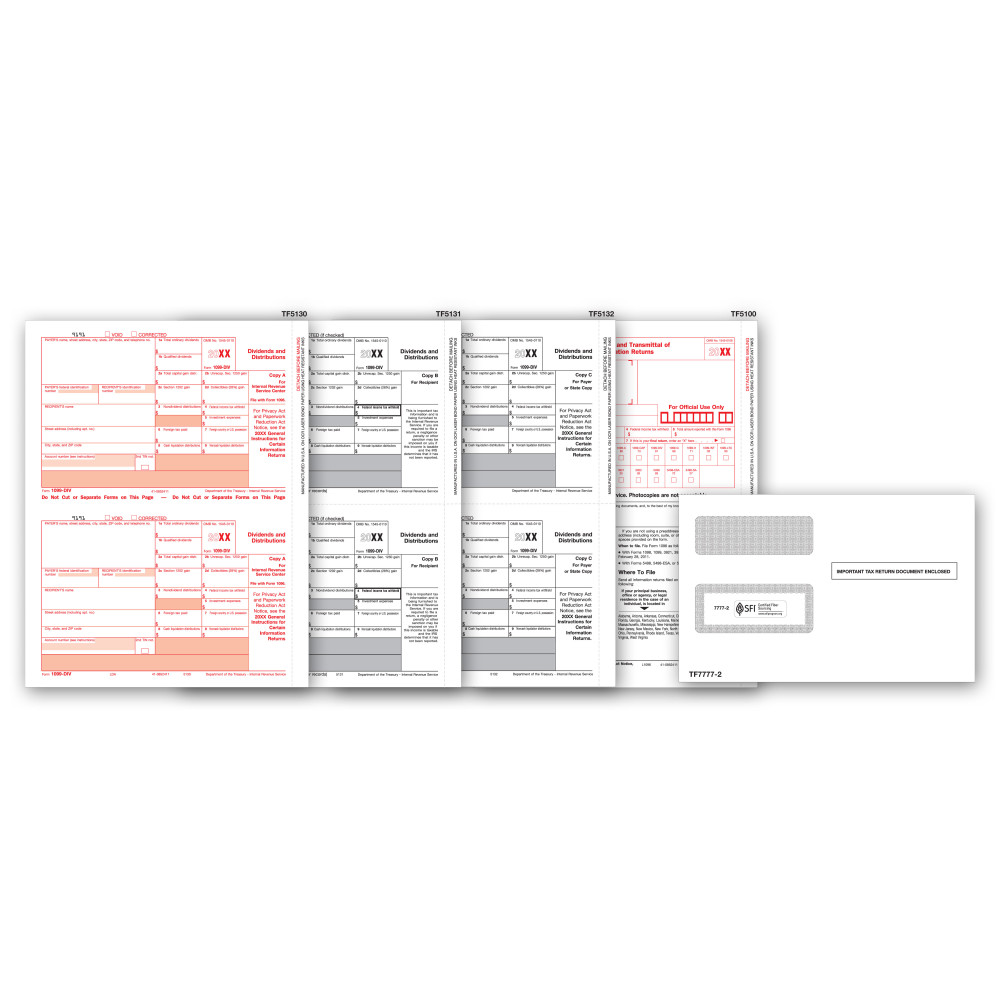

Meets all government and IRS filing requirements.All the laser 1099-DIV tax forms and envelopes you need in 1 package, for 1 low price! Popular format is ideal for reporting dividends and distributions.

Paper Filing Due Date: To Recipient January 31st.

The 1099-DIV tax form is a record of all taxable capital gains and dividends paid to investors during a tax year. This includes reinvested dividend. Investors use this information to help report income received from their investments on their annual tax return each year.

It is our endeavor to provide user friendly tax forms to suit individual requirements. This is a set of 4 1099-DIV tax forms – One copy each of Copy A and B and two of state or payer’s Copy C –3 laser transmittals and 50 self seal envelopes. Sold in packages of 50 sets, each sheet has two 1099-DIVs printed on recycled paper, printable on laser or inkjet printers.

TF6107E, Laser 1099 Forms with Envelopes - Dividend Income - 4 Part

- Item# TF6107E

- Size: 8 1/2" x 11"

- Meets 4-part state filing requirements

- 2 Filings per sheet

- Report $10 or more, except $600 or more for liquidations

- Includes:

- - 50 Federal Copy A

- - 50 Recipient Copy B

- - 100 Payer and/or State Copy C

- - 3 Laser 1096 Transmittals

- - 50 Envelopes

- Min. Order: 1 Pack

We only carry forms for the current tax year.