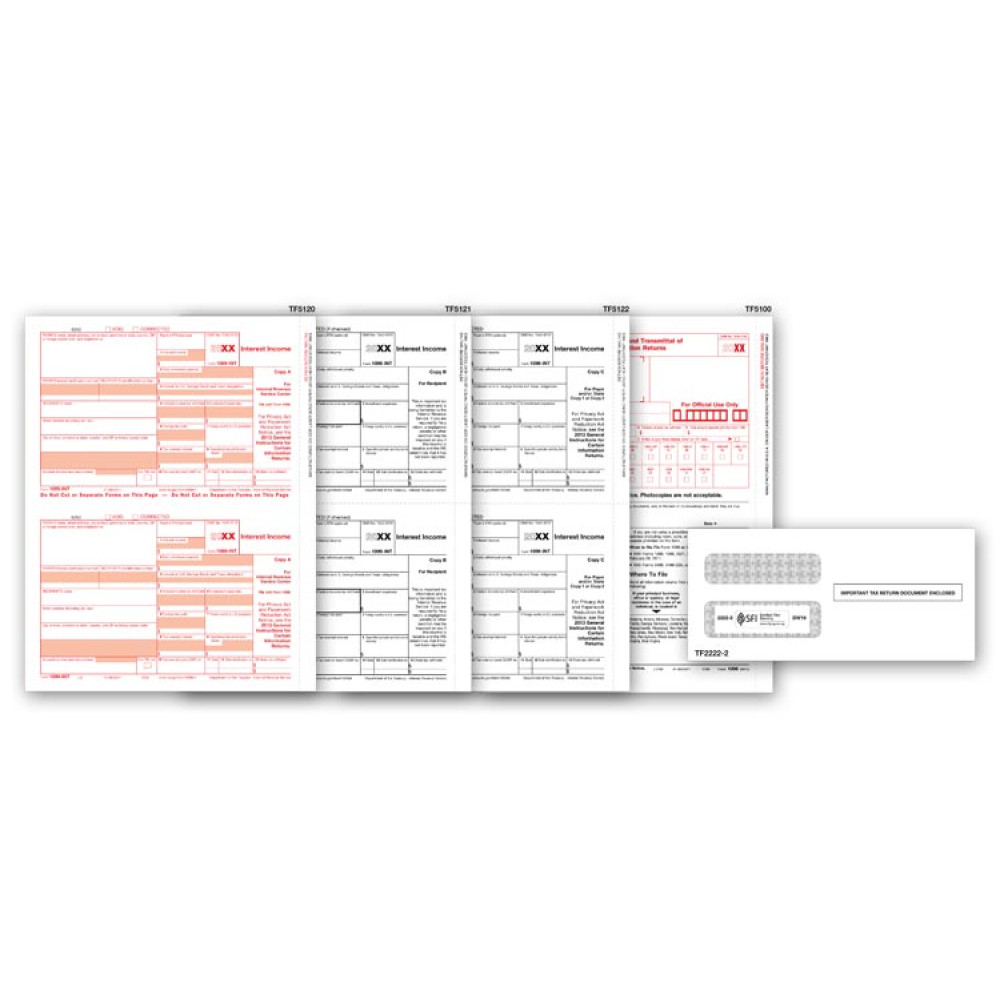

TF6104E, 1099 Forms for Interest Income with Envelopes

- Item# TF6104E

- Size: 8 1/2" x 11"

- For up to 50 employees

- Includes:

- 50 Federal Copy A

- 50 Recipient Copy B

- 100 Payer and/or State Copy C

- 3 Laser 1096 Transmittals

- 50 Envelopes

- Meets 3-part state filing requirements

- IRS approved

- Report $10 or more ($600 or more in some cases)

- Min. Order: 1 Pack

Related Products

Popular format is ideal for reporting interest income. Meets all government and IRS filing requirements.All the laser 1099-INT tax forms and envelopes you need in 1 package, for 1 low price!

Paper Filing Due Date: To Recipient January 31st.

Continuous tax forms are convenient inasmuch as they support carbon copies. With laser forms you need to feed each copy at a time. Laser forms however make excellent presentation material. For adding the dot matrix type of convenience to laser forms, we offer sets of 1099-INT tax forms that suffice for 3-part state filing requirements. Each set contains 50 forms of Copy A and B and 100 of State or payer Copy C. The 3 transmittals and 50 self seal envelopes included in each set further add to the convenience of printing these laser forms.

1099-INT is an annual tax statement provided by payers of interest income, summarizing interest income for the tax year and typically includes withheld taxes. All Information provided on Form 1099-INT is reported to the IRS and copies sent to recipients.

There are no reviews for this product.

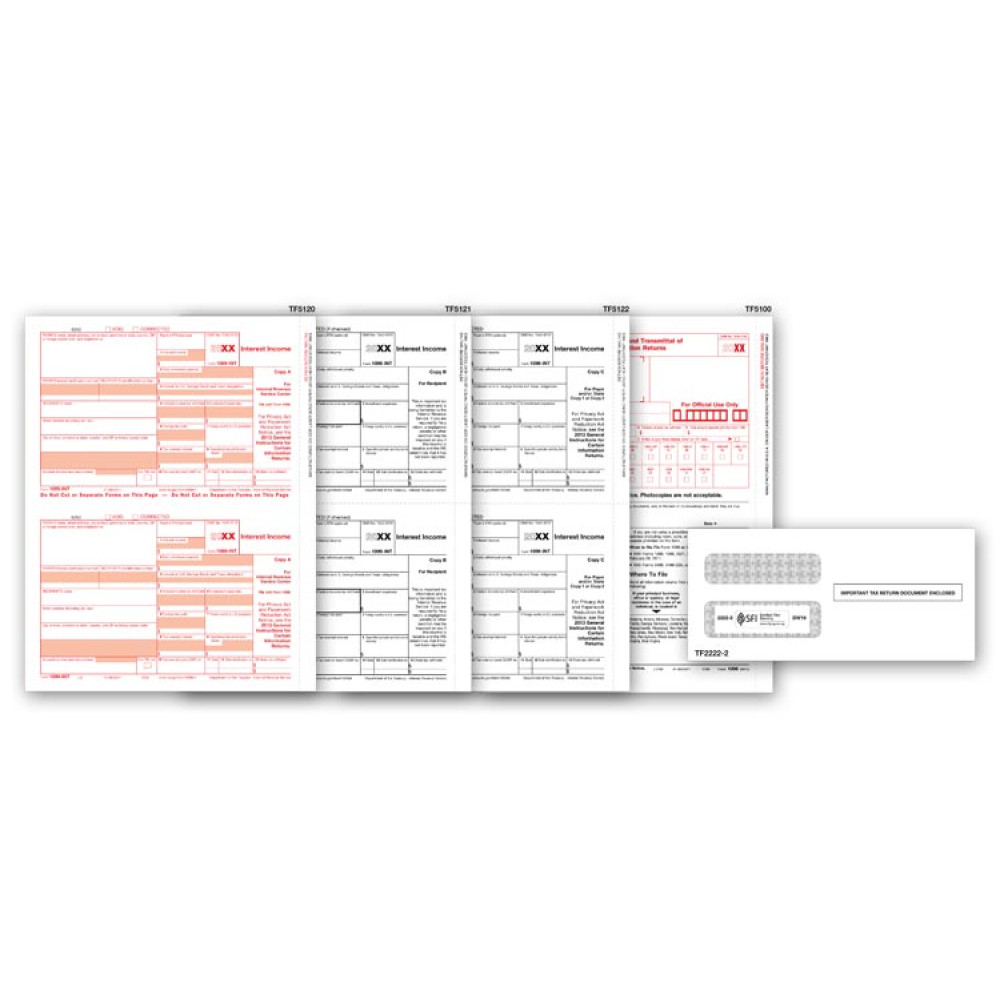

TF6104E, 1099 Forms for Interest Income with Envelopes

- Item# TF6104E

- Size: 8 1/2" x 11"

- For up to 50 employees

- Includes:

- 50 Federal Copy A

- 50 Recipient Copy B

- 100 Payer and/or State Copy C

- 3 Laser 1096 Transmittals

- 50 Envelopes

- Meets 3-part state filing requirements

- IRS approved

- Report $10 or more ($600 or more in some cases)

- Min. Order: 1 Pack