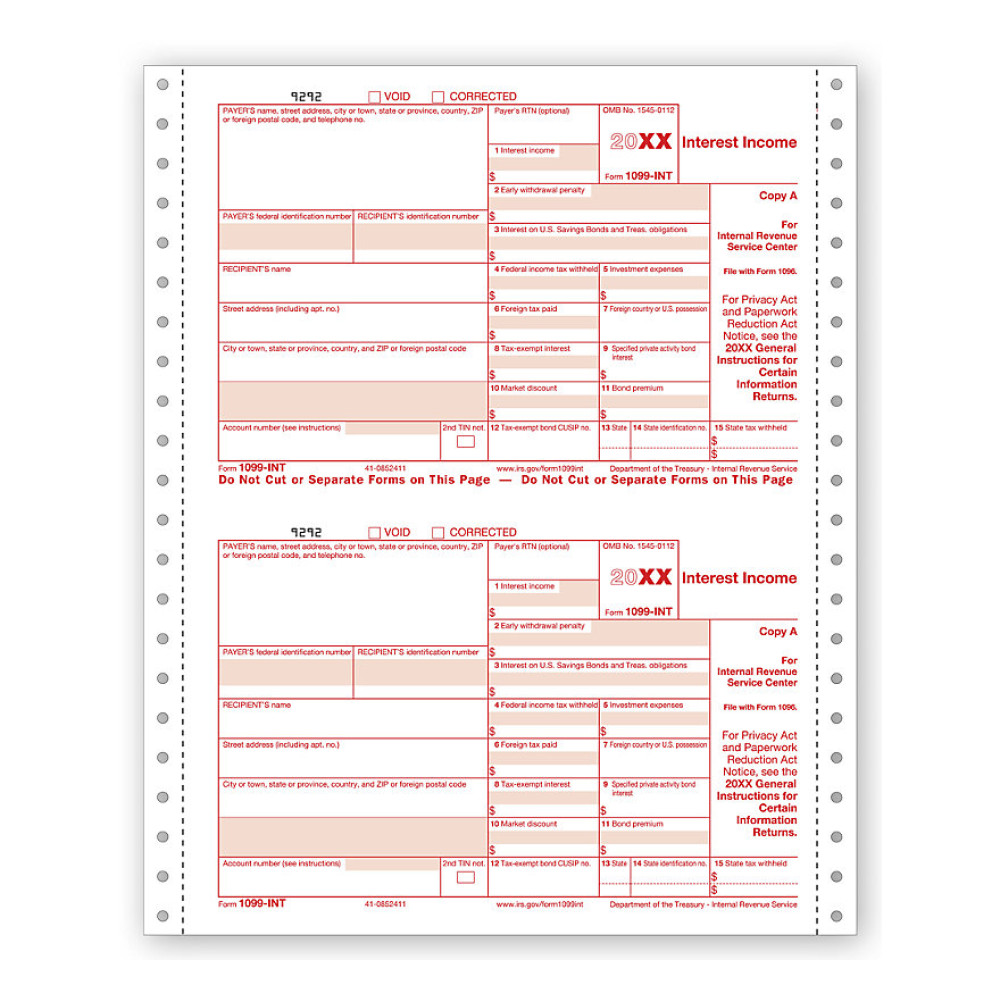

TF7150, Continuous 1099-INT - Interest Income Copy B

- Item# TF7150

- Size: 9" x 3 2/3"

- Printed on recycled paper

- Three forms per sheet

- 1099-INT Interest Income

- Use to report interest paid

- Recipient Copy B

- For printers that accommodate 9" wide forms

- Continuous tax form to be used with a dot matrix printer

- 1-part, 3-part or 4-part carbonless

- 4-part forms meet the needs of all 50 states

- Use to report interest payments of $10.00 or more paid to any one individual by banks, credit unions and like associations. Does not include interest on IRA

- Min. Order: 50

Related Products

Companies required to file 250 or more returns must file electronically. Just what you need when filing electronically! Popular format is ideal for reporting interest income.

Paper Filing Due Date: To Recipient January 31st.

Use these 1099-INT tax forms for printing information to be filed with the IRS and for sending to recipients on your continuous dot matrix printer that supports 9” wide paper. Tax forms 1099-R are used for reporting interest incomes above $10 – generally paid by banks, credit unions and other financial institutions. The product displayed here is three forms per page – 9” by 3 2/3” and available for 1 to 4 part filing requirements. 4-part 1099-INT forms meet the filing needs of all 50 States.

We suggest that before you order, ensure that you know the right quantity you require as there is a huge difference between the price applicable to large and small orders.

Don't forget the compatible envelopes: TF22222

There are no reviews for this product.

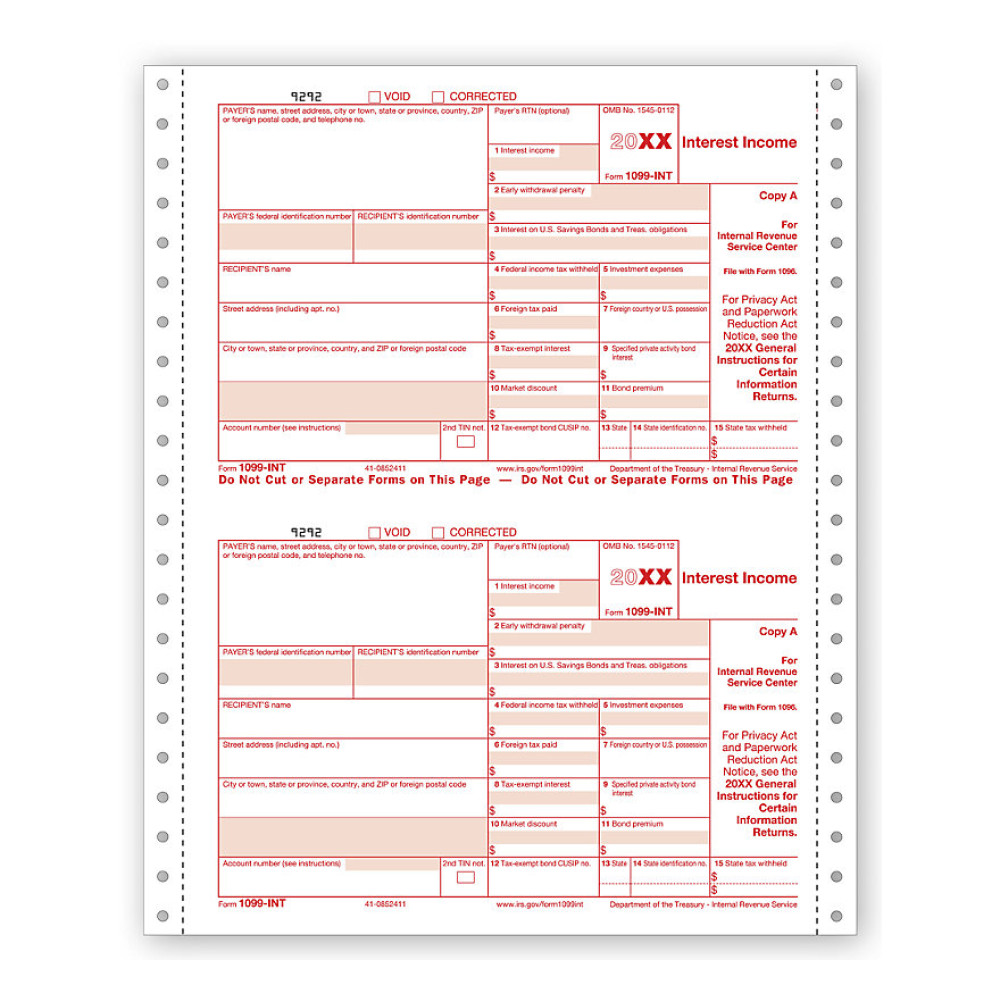

TF7150, Continuous 1099-INT - Interest Income Copy B

- Item# TF7150

- Size: 9" x 3 2/3"

- Printed on recycled paper

- Three forms per sheet

- 1099-INT Interest Income

- Use to report interest paid

- Recipient Copy B

- For printers that accommodate 9" wide forms

- Continuous tax form to be used with a dot matrix printer

- 1-part, 3-part or 4-part carbonless

- 4-part forms meet the needs of all 50 states

- Use to report interest payments of $10.00 or more paid to any one individual by banks, credit unions and like associations. Does not include interest on IRA

- Min. Order: 50