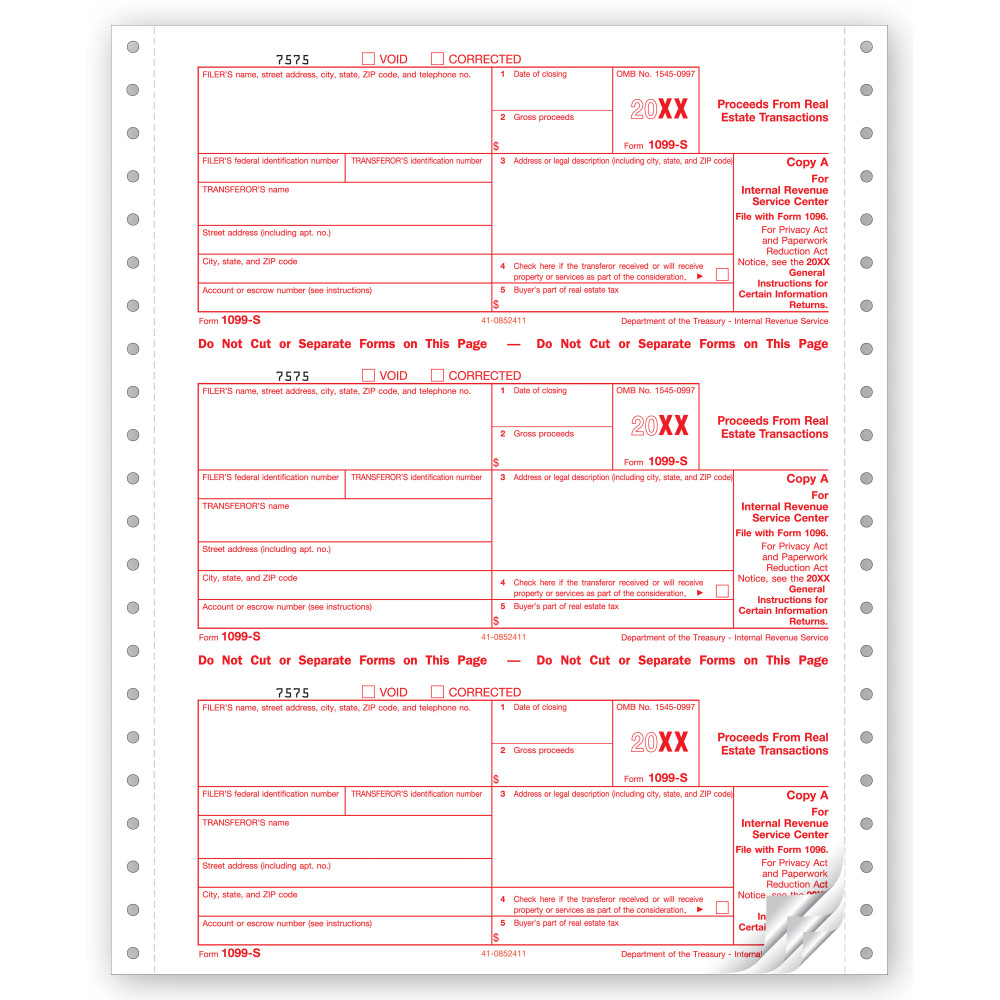

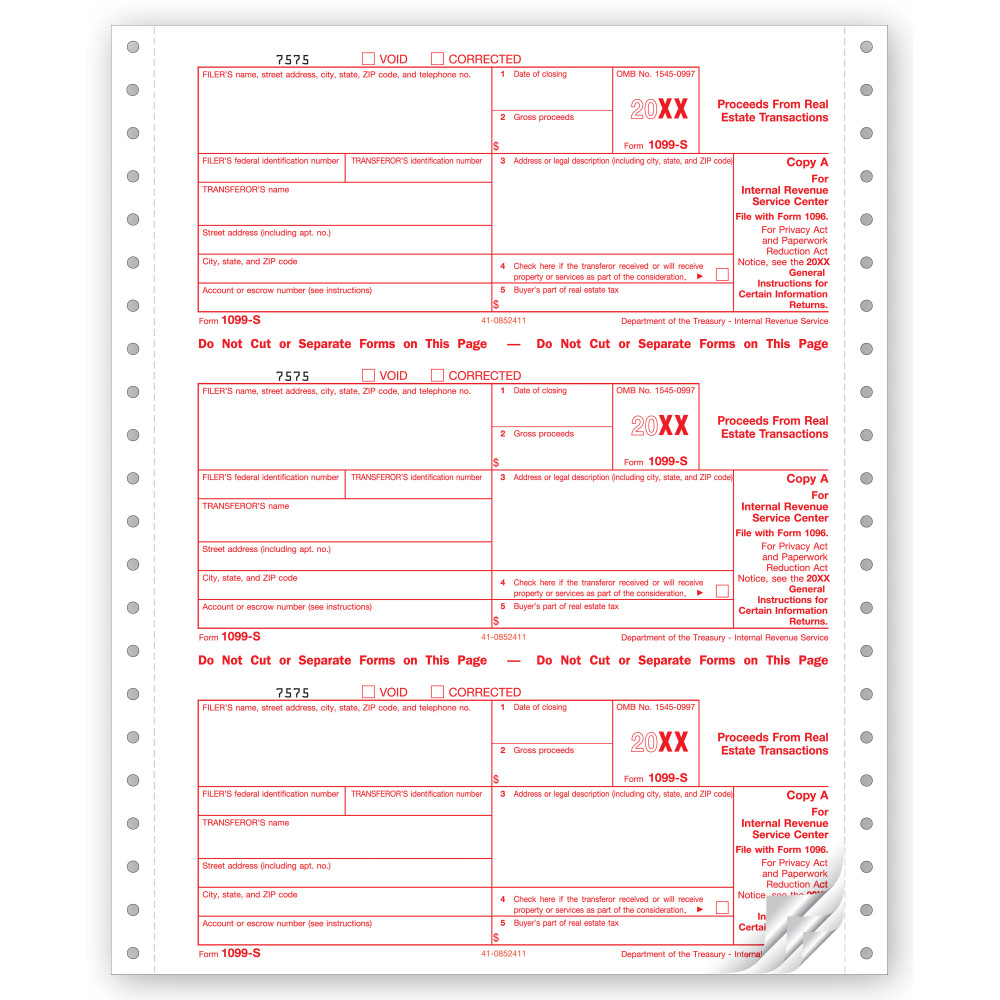

TF7160, Continuous 1099-S

- Item# TF7160

- Size: 8" x 3 2/3"

- Printed on carbonless (NCR) stock

- Continuous tax form to be used with your dot matrix printer

- Min. Order: 25 forms

Related Products

Meets all government and IRS filing requirements.Popular format is ideal for reporting proceeds from real estate transactions.

Paper Filing Due Date: To Recipient January 31st.

Sale or exchange of any present or future ownership interest in real estate property is reported in federal tax forms 1099-S and filed with the IRS and a copy of the same sent to the transferor. A sale or exchange includes an involuntary conversion due to a disaster or the imposition of imminent domain by a governmental unit but does not include foreclosure sales and sales with total consideration less than $600.

Typically, filers require three copies – one for the IRS, the transferor and a file copy. We offer continuous 1099-S tax forms for printing on a dot matrix printer. Designed as two-forms per page, these IRS approved forms are printed on carbonless (NCR) recycled stock.

Don't forget the compatible envelopes: TF22222

There are no reviews for this product.

TF7160, Continuous 1099-S

- Item# TF7160

- Size: 8" x 3 2/3"

- Printed on carbonless (NCR) stock

- Continuous tax form to be used with your dot matrix printer

- Min. Order: 25 forms