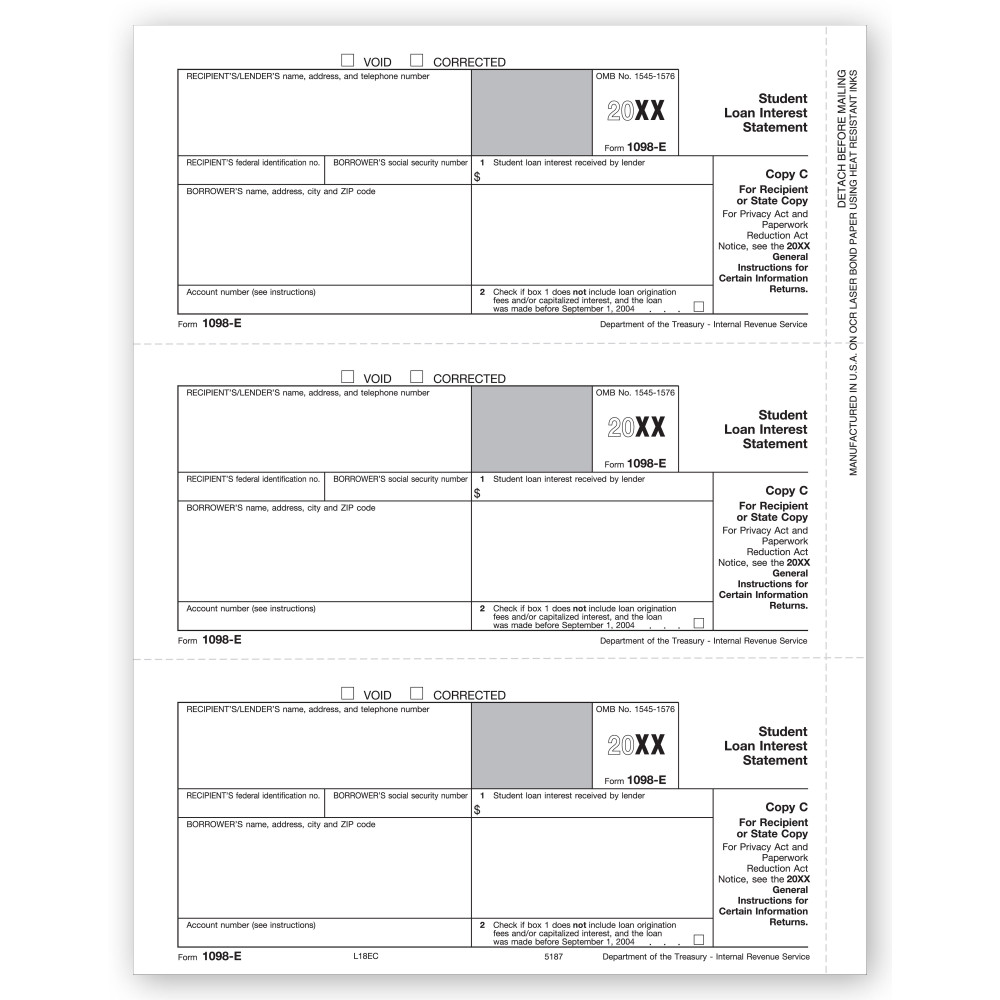

TF5187, Laser 1098-E Form - Recipient and/or State Copy C

- Item# TF5187

- Size: 8 1/2" x 11"

- Use to report student loan interests

- Printed on carbonless (NCR) stock

- Meets IRS specifications

- State or Recipient Copy C

- Three forms per sheet

- Min. Order: 100

Related Products

Meets all government and IRS filing requirements.Popular format is ideal for reporting student loan interest.

Paper Filing Due Date: To Recipient January 31st.

All tax forms have a number of copies –from three to six. In certain cases, filers have to print even eight copies of each filing. When it comes to copies of tax forms, you will not find us wanting. We have on offer different copies of all tax forms in small packages as well as in bulk cartons.

Displayed here is Copy C or the recipient’s copy of tax form 1098-E, the Student Loan Interest Statement that lenders are required to file with the IRS every year. Copy C is also used for reporting the interest to that student’s state, city or local tax department, if required.

Don't forget the compatible envelopes: TF22222

There are no reviews for this product.

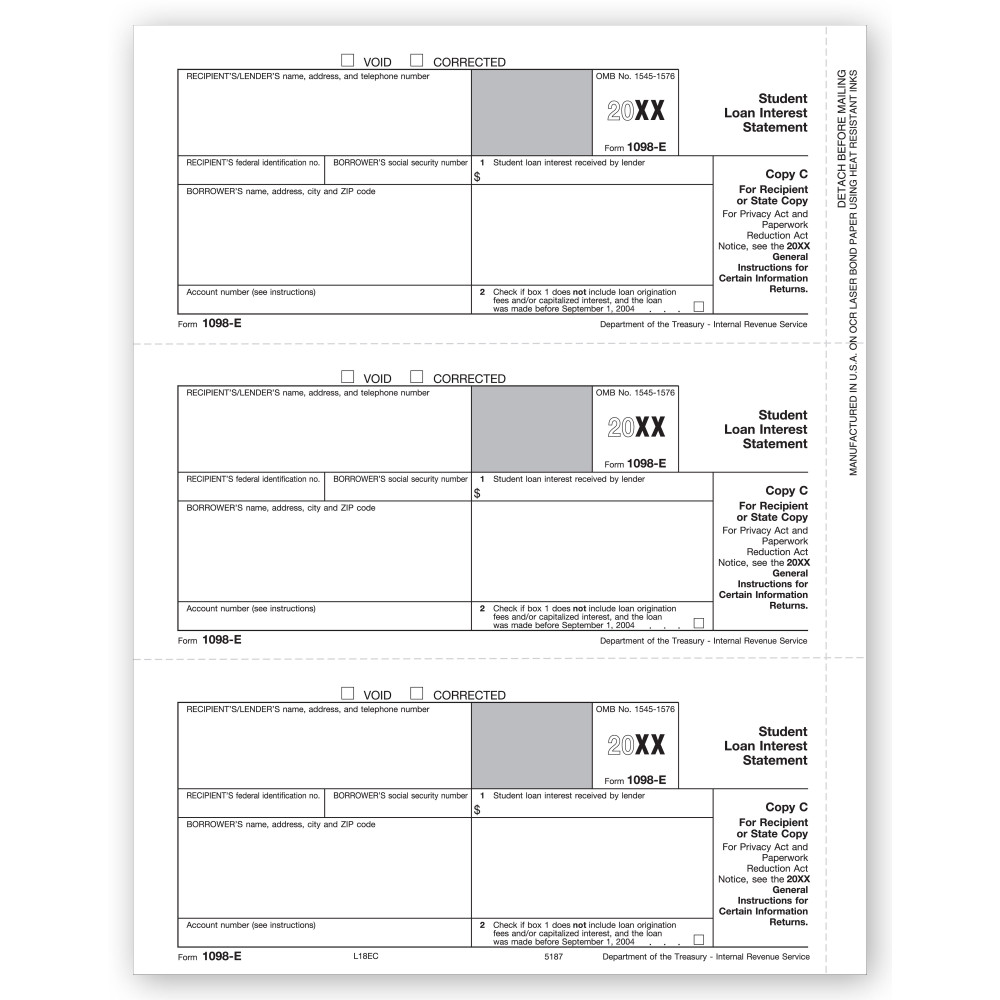

TF5187, Laser 1098-E Form - Recipient and/or State Copy C

- Item# TF5187

- Size: 8 1/2" x 11"

- Use to report student loan interests

- Printed on carbonless (NCR) stock

- Meets IRS specifications

- State or Recipient Copy C

- Three forms per sheet

- Min. Order: 100