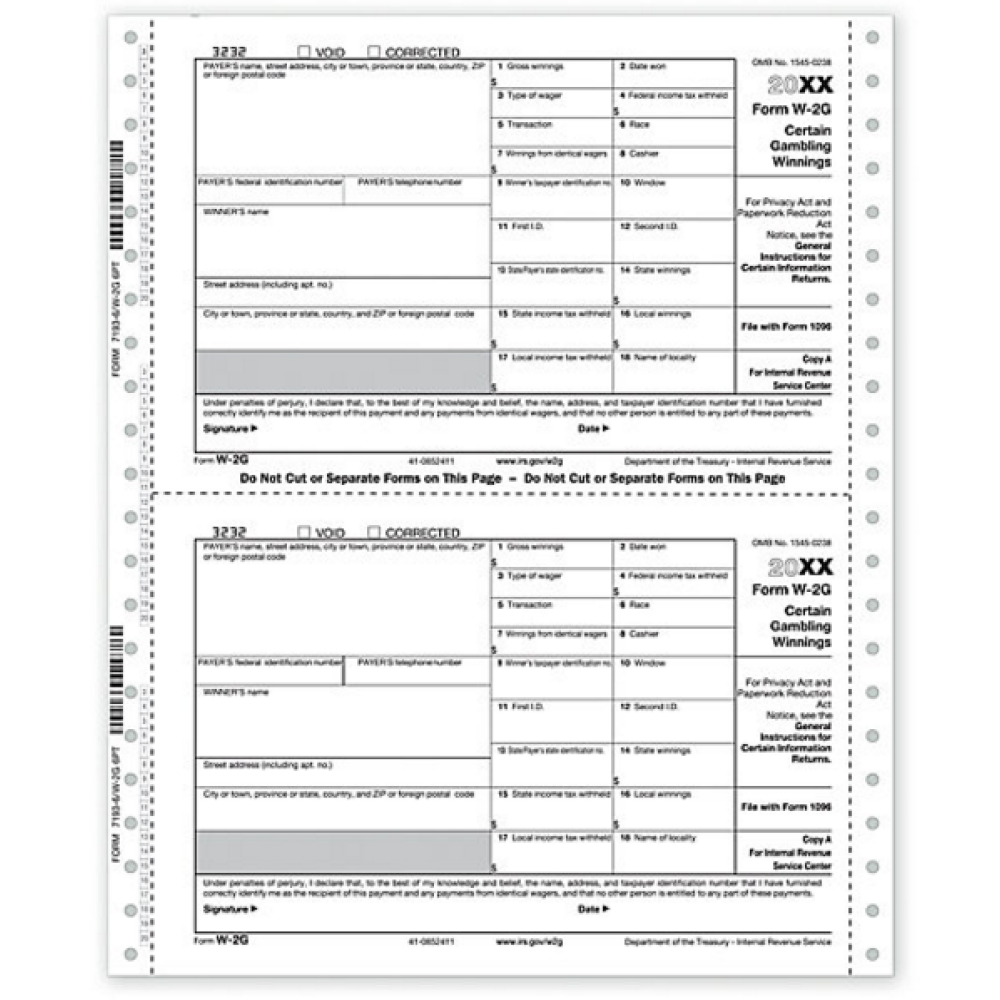

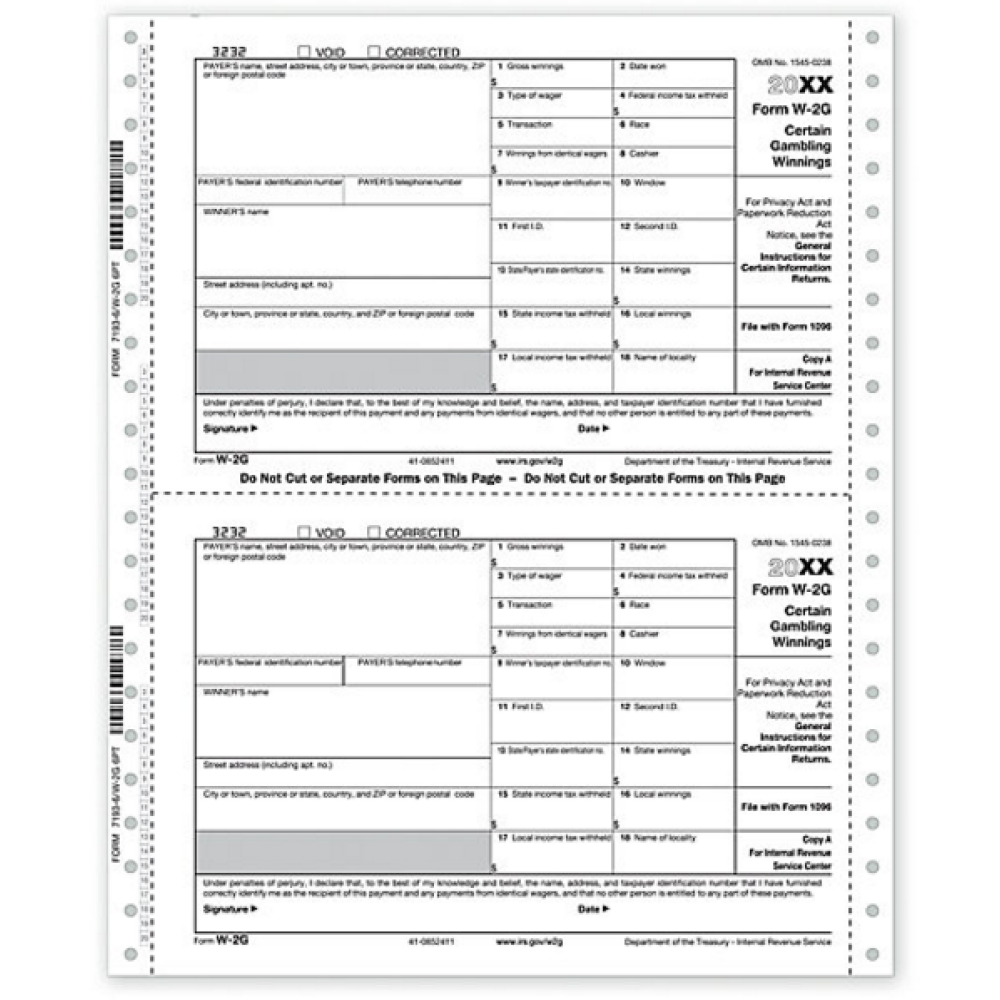

TF7193-6, Continuous W-2G Form, 6-part

- Item# TF7193

- Size: 7 1/2" x 3 7/8"

- Meets 6-part state filing requirements

- Dateless

- Approved by the IRS

- Min. Order: 25 forms

Related Products

Paper Filing Due Date: To Recipient January 31st.

Use to Report: Gambling winnings from horse racing, dog racing, jai alai, lotteries, keno, bingo, slot machines, sweepstakes, wagering pools, poker tournaments, etc.

For the purpose of income tax, gambling includes but not limited to, winnings from lotteries, raffles, horse and dog races and casinos, as well as the fair market value of prizes such as cars, houses, trips or other noncash prizes. If anyone wins $600 or more certain gambling winnings are reported to the IRS and taxable in the hands of the winner. Gambling winnings are reported in tax form W-2G. Displayed on this page is federal tax form W22G for 6-part state filing.

Amounts to Report: Generally $600 or more.

There are no reviews for this product.

TF7193-6, Continuous W-2G Form, 6-part

- Item# TF7193

- Size: 7 1/2" x 3 7/8"

- Meets 6-part state filing requirements

- Dateless

- Approved by the IRS

- Min. Order: 25 forms