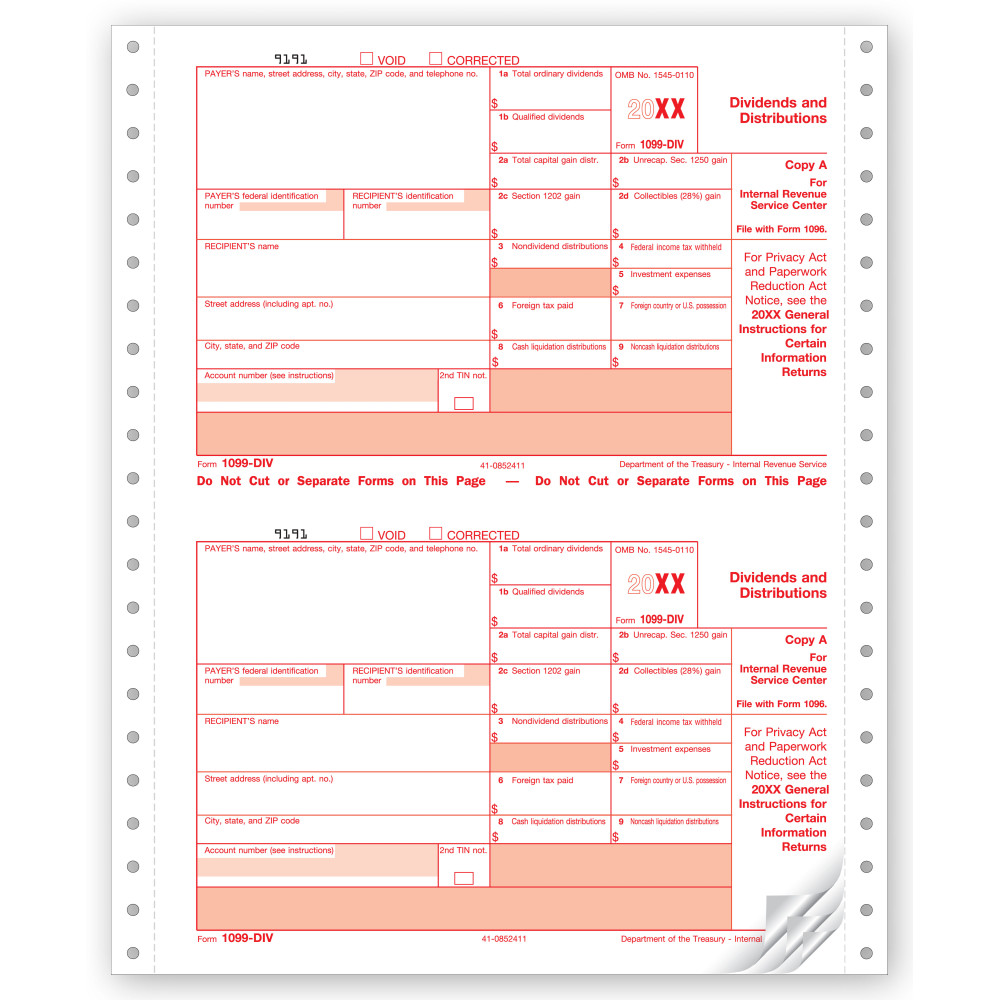

TF7152, Continuous 1099-DIV Dividend Income - Magnetic Media

- Item# TF7152

- Size: 8 1/2" x 11"

- IRS approved

- Continuous 1099

- Printed on recycled paper

- Min. Order: 25 forms

Related Products

Companies required to file 250 or more returns must file electronically. Just what you need when filing electronically! Popular format is ideal for reporting dividends and distributions.

Paper Filing Due Date: To Recipient January 31st.

Corporations and mutual funds need to issue a 1099-DIV tax forms telling their shareholders the amount dividend income they received during the year. The same information is prepared in the same 1099-DIV tax form Copy A, the facsimile image of which is displayed above, and sent to the IRS Service Center for reporting the income to the federal tax authority.

We offer continuous tax form 1099-DIV, Copy A for printing on dot matrix printer. Supplied as two forms per letter size sheet, our forms are IRS approved and updated with latest amendments, if any. We also offer all types of forms for printing on laser or inkjet printers.

Don't forget the compatible envelopes: TF77772

There are no reviews for this product.

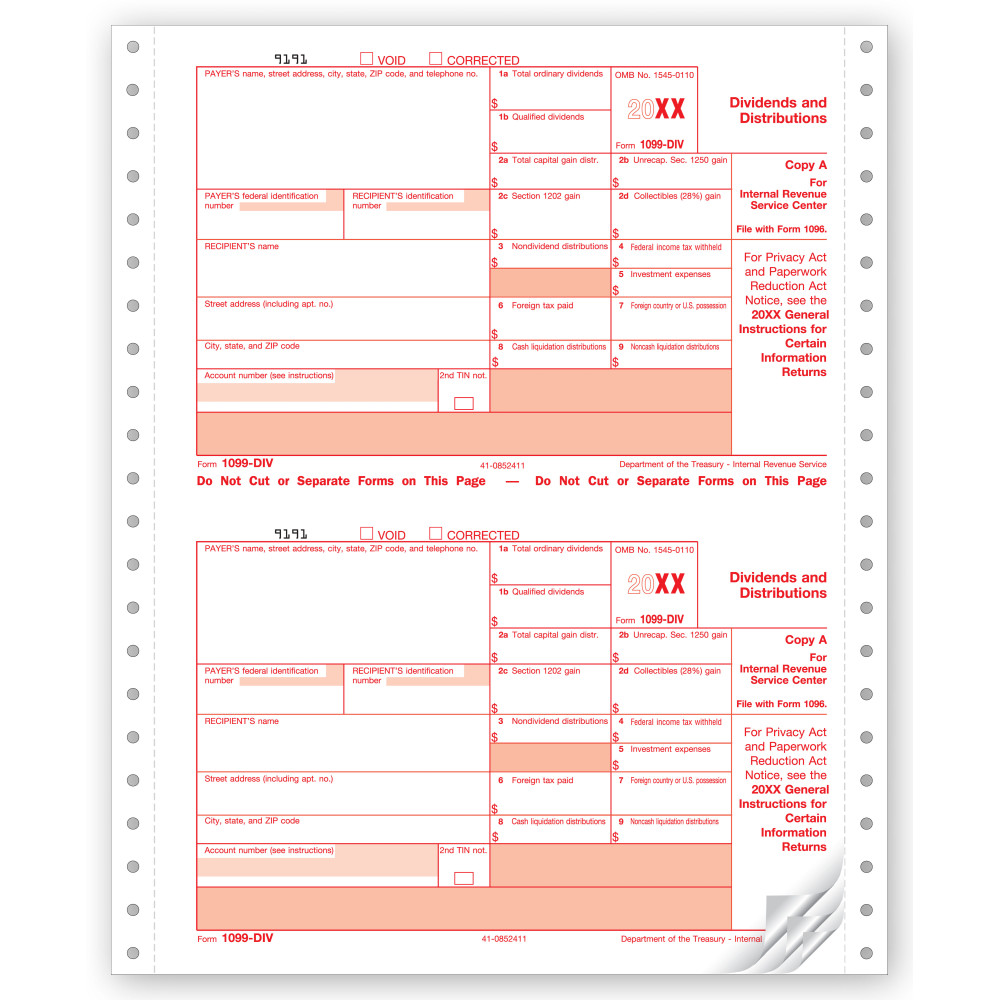

TF7152, Continuous 1099-DIV Dividend Income - Magnetic Media

- Item# TF7152

- Size: 8 1/2" x 11"

- IRS approved

- Continuous 1099

- Printed on recycled paper

- Min. Order: 25 forms